PROGRAMMATIC SALES EXECUTION

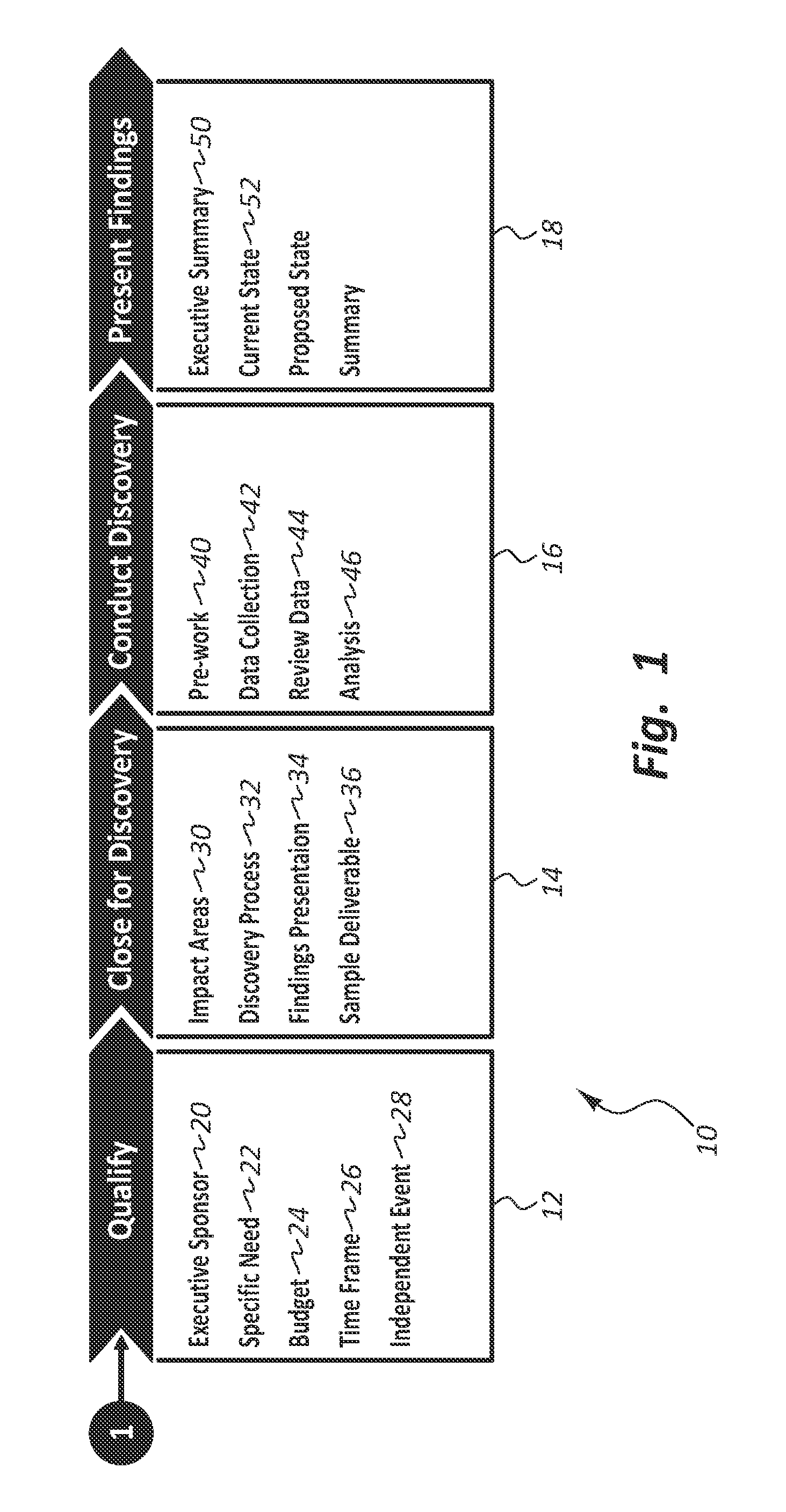

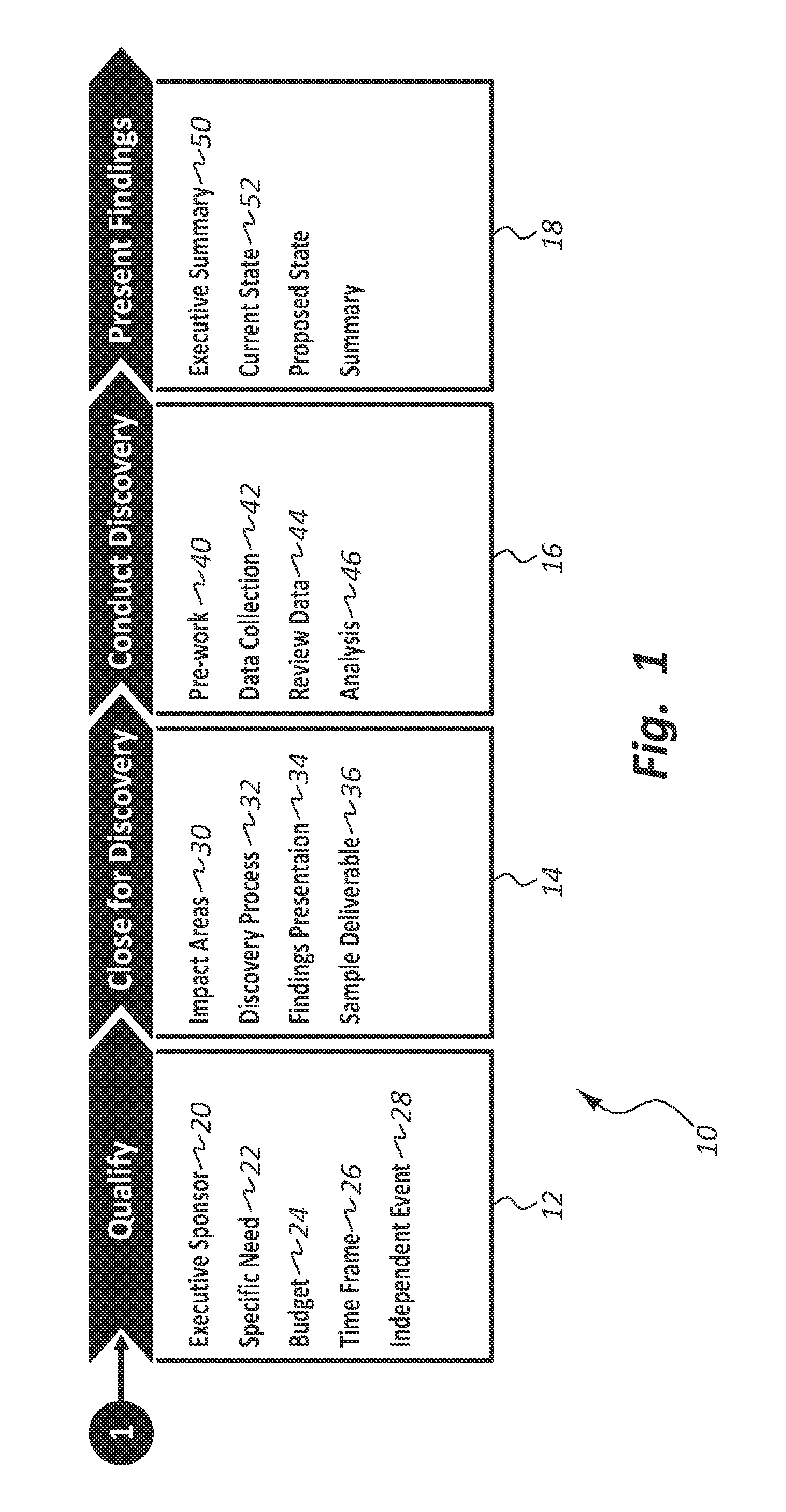

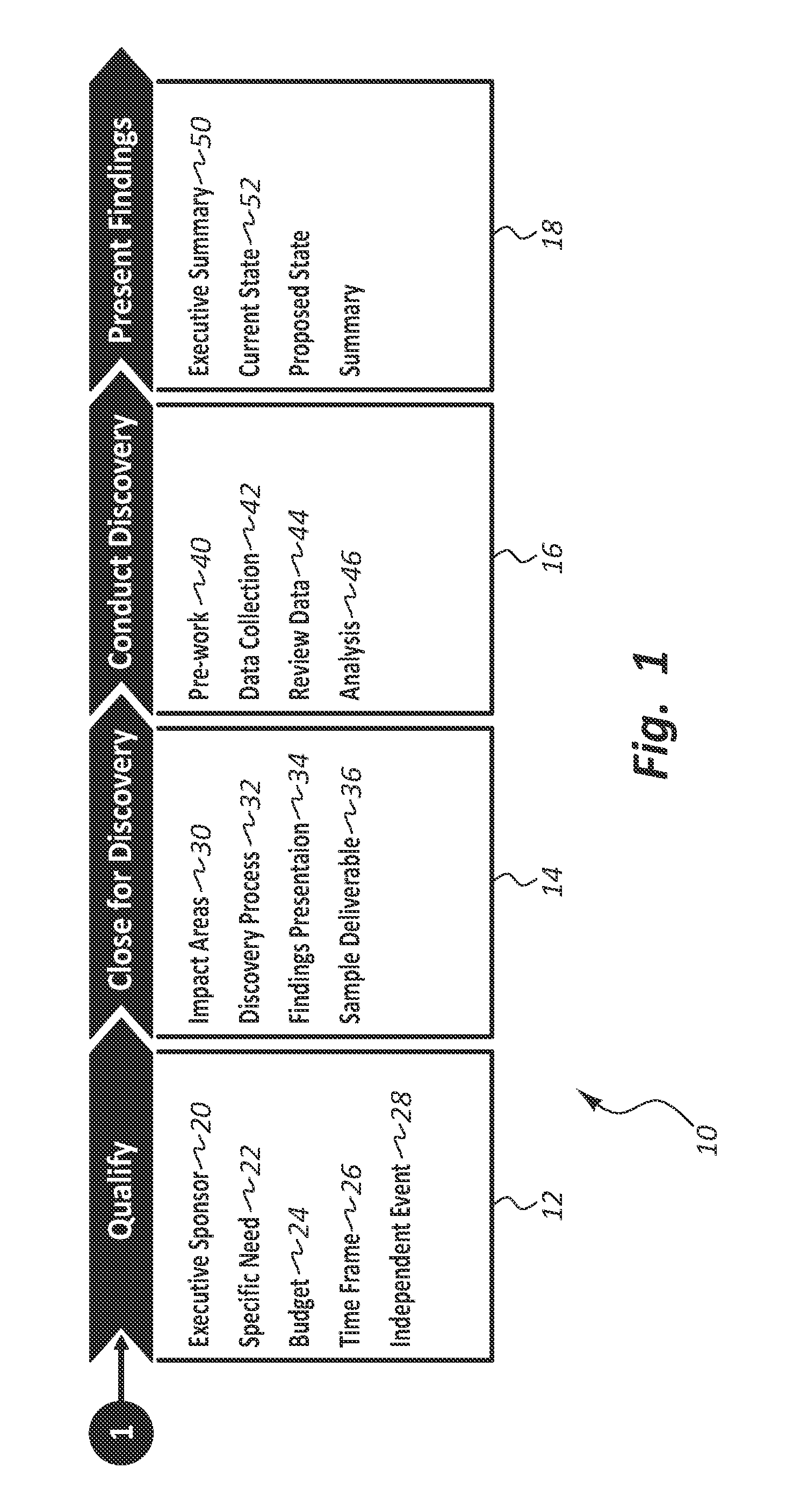

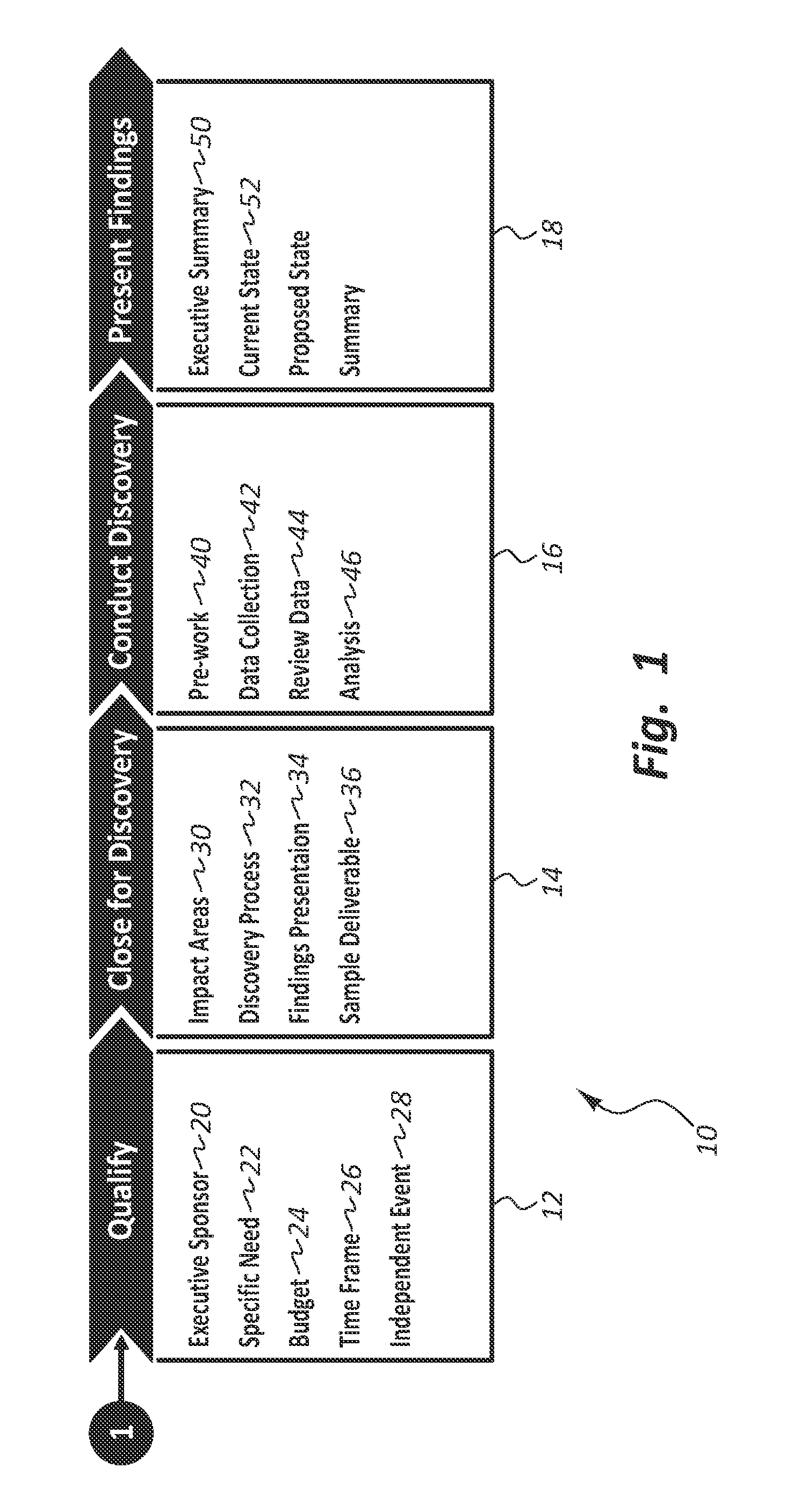

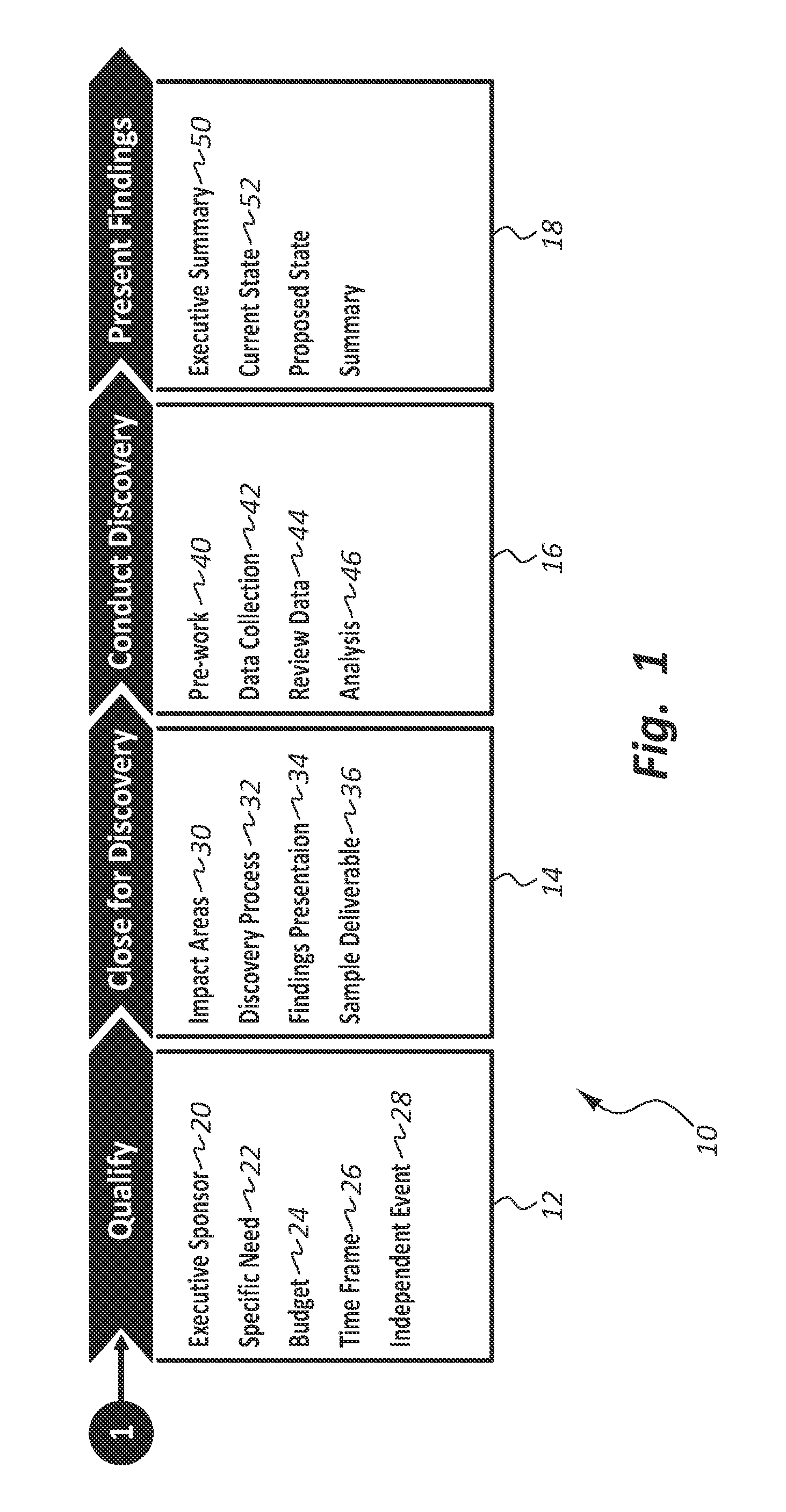

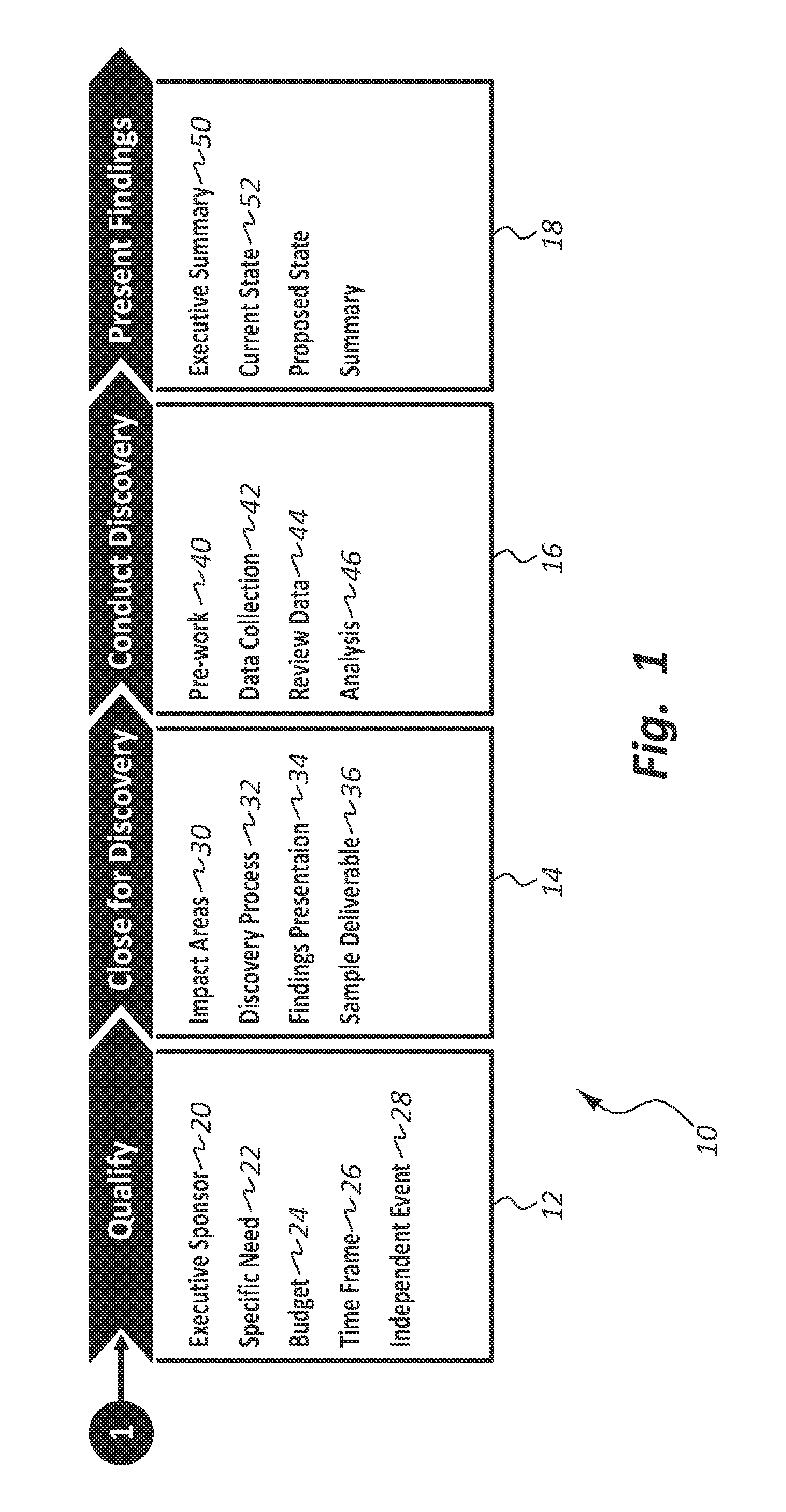

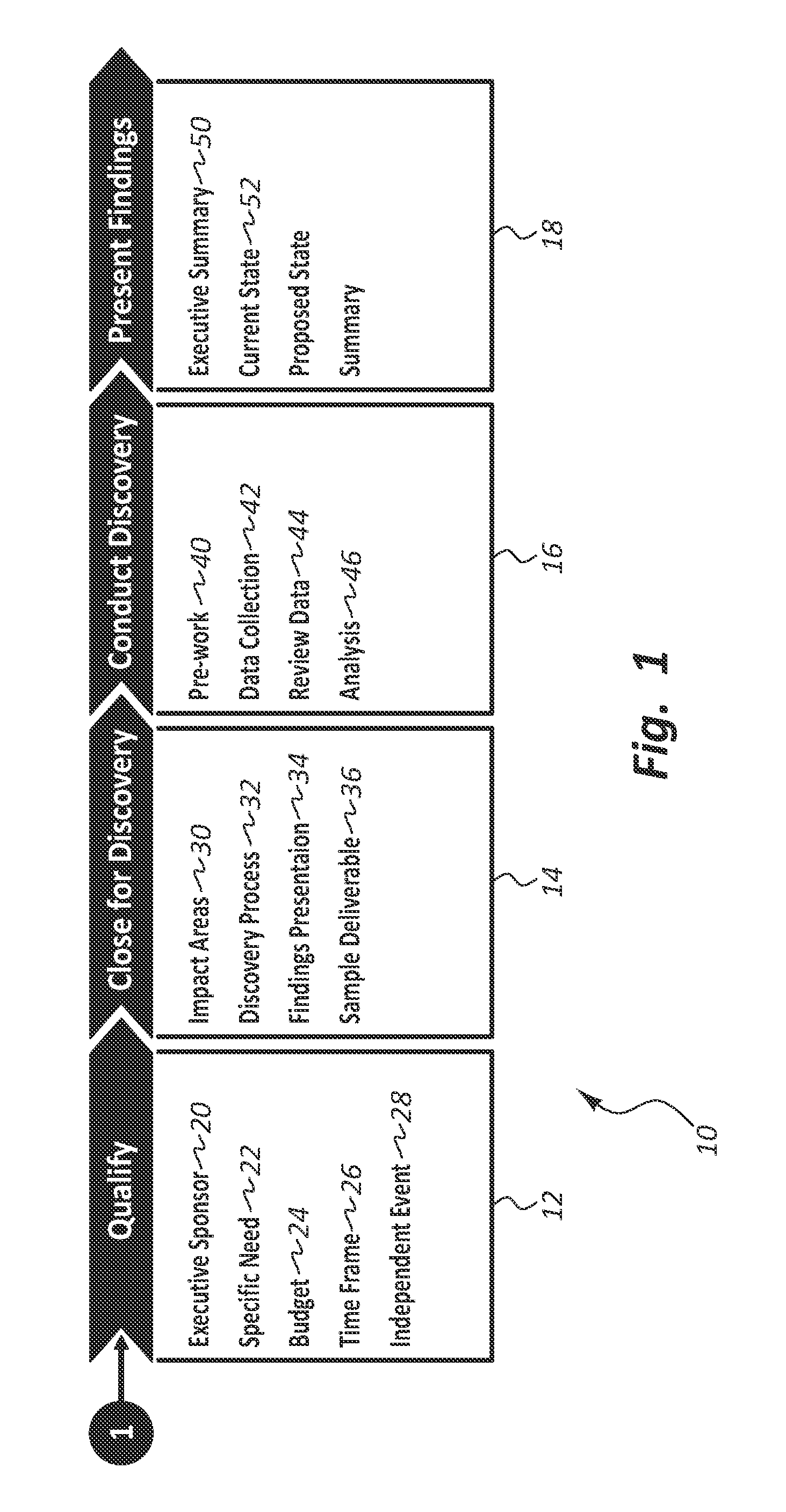

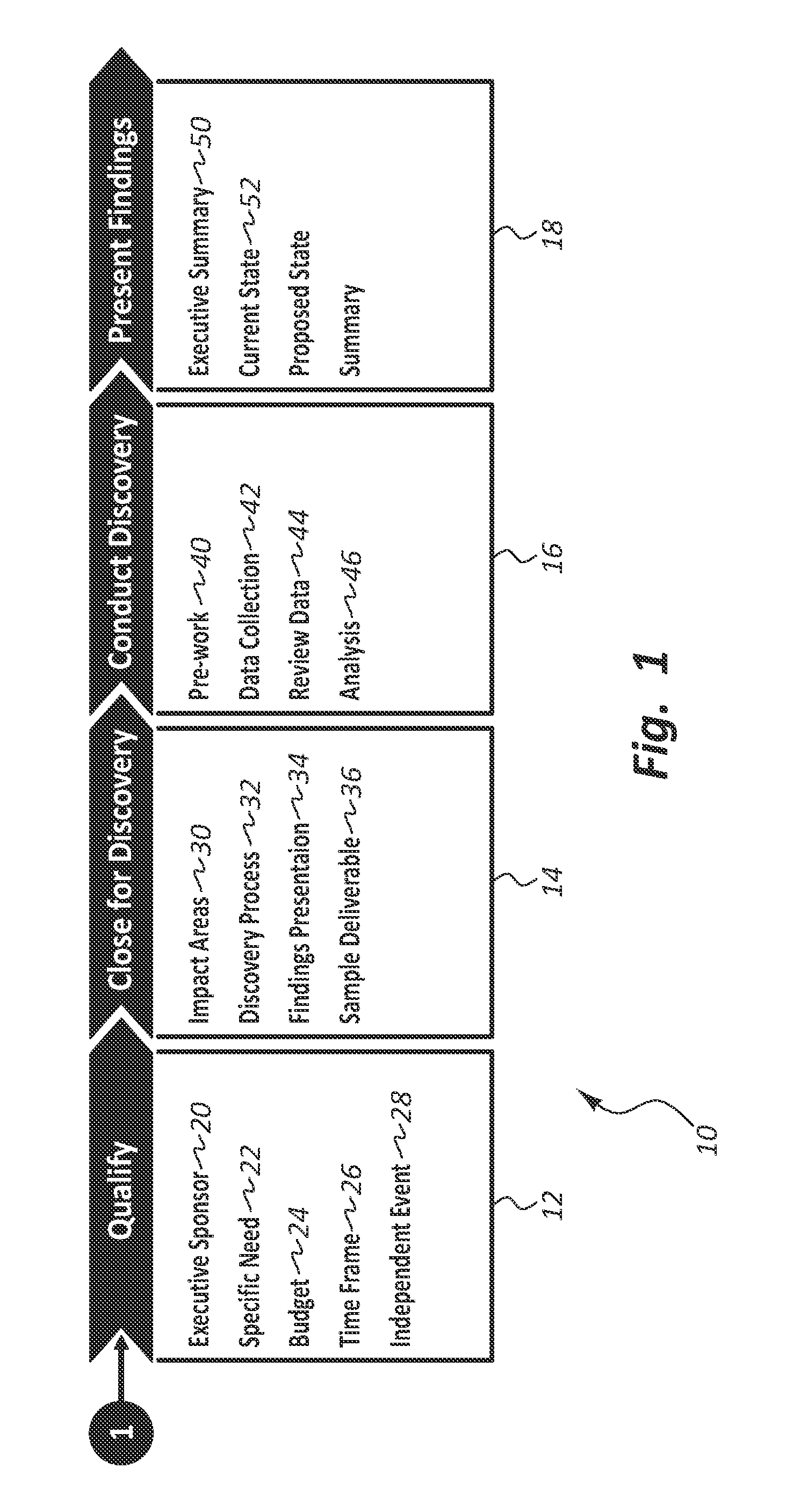

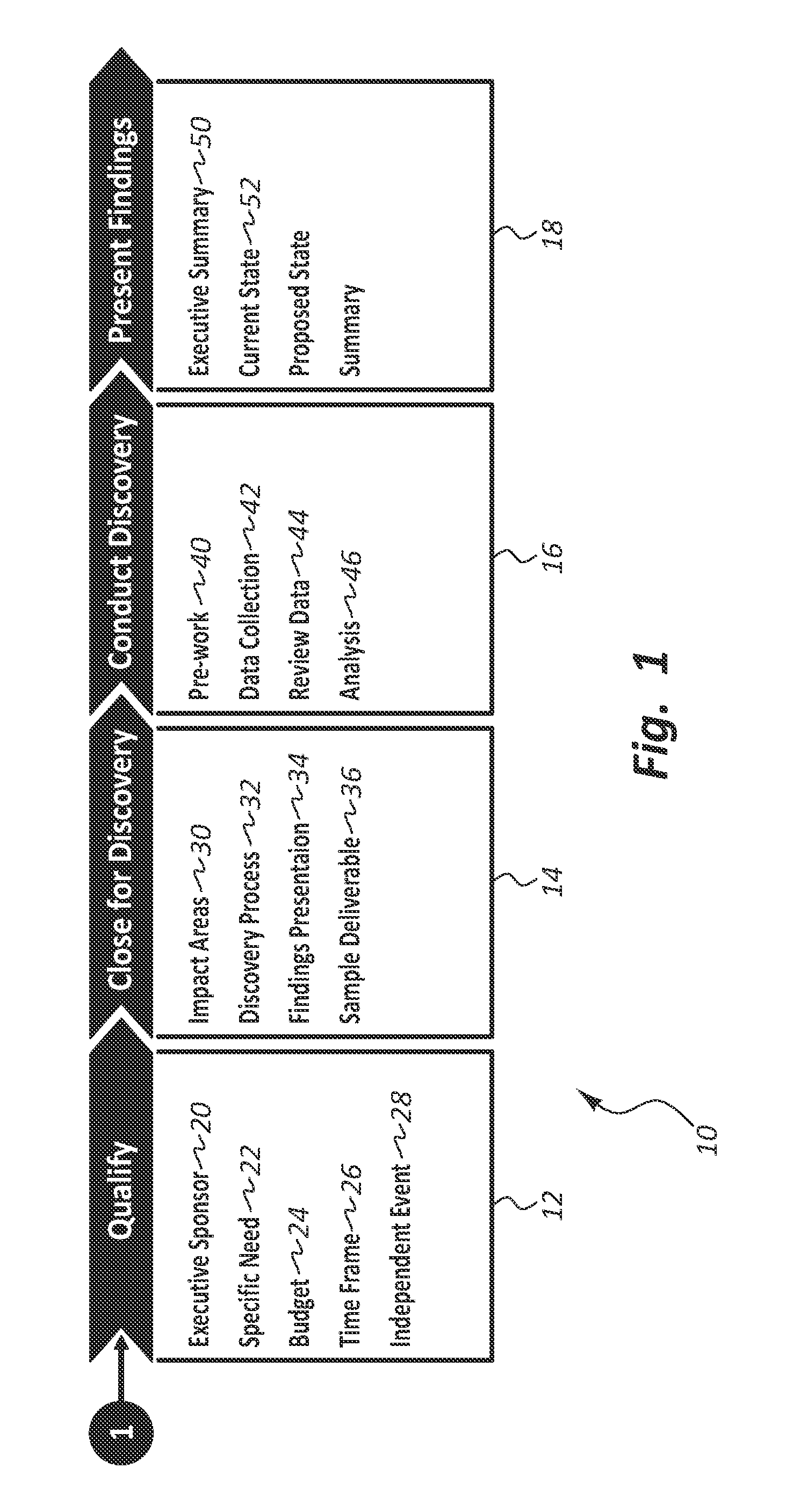

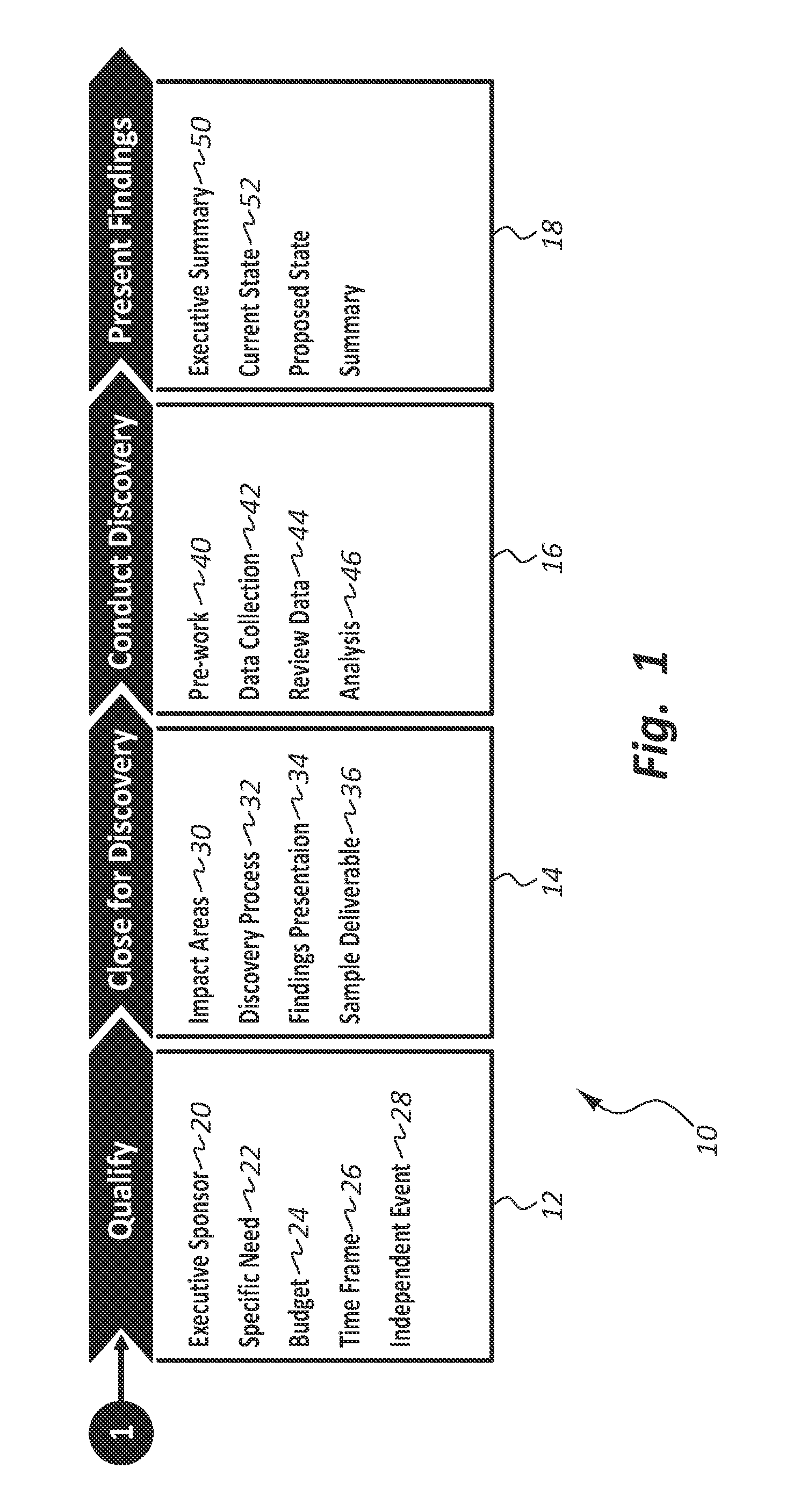

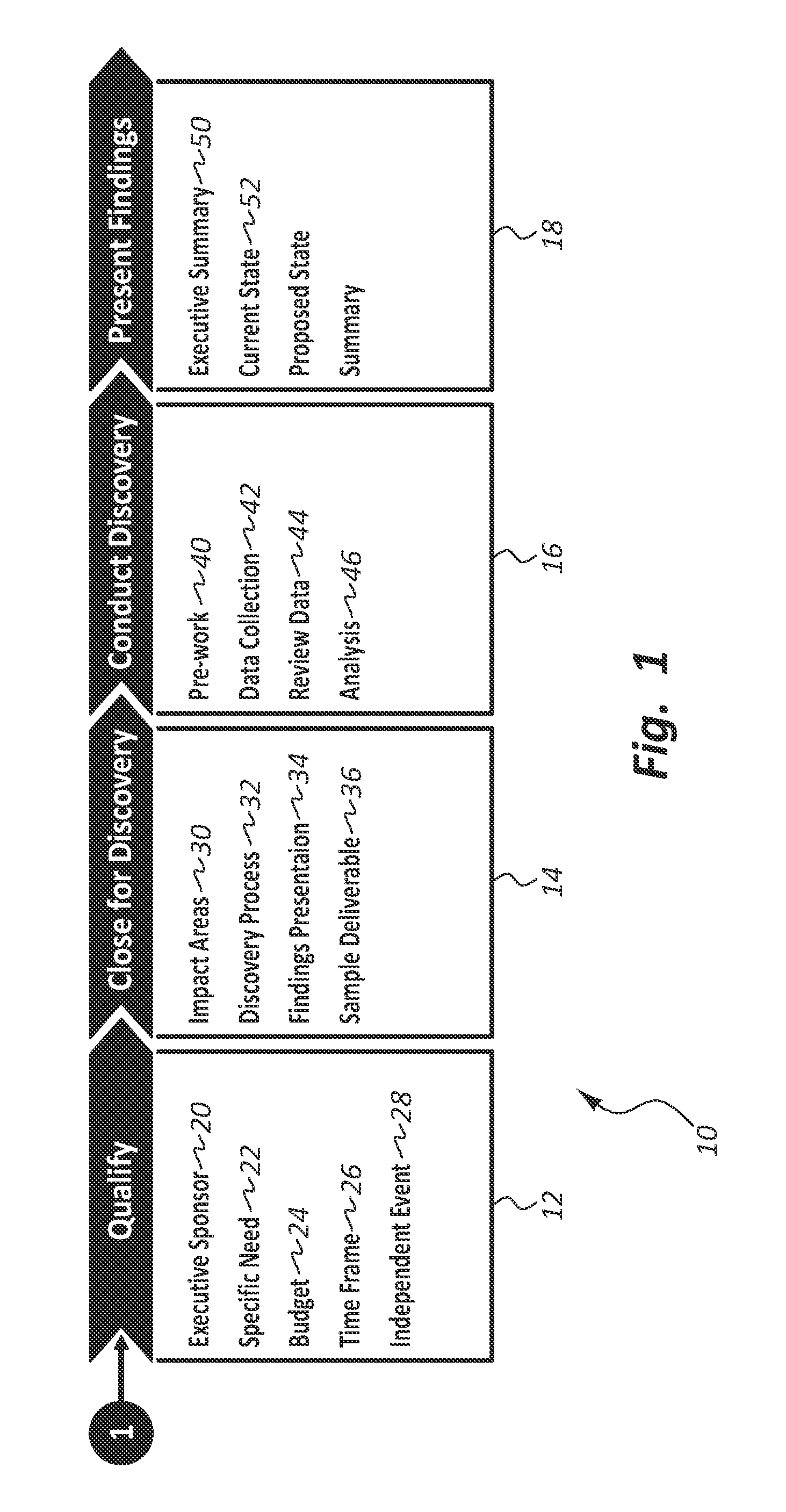

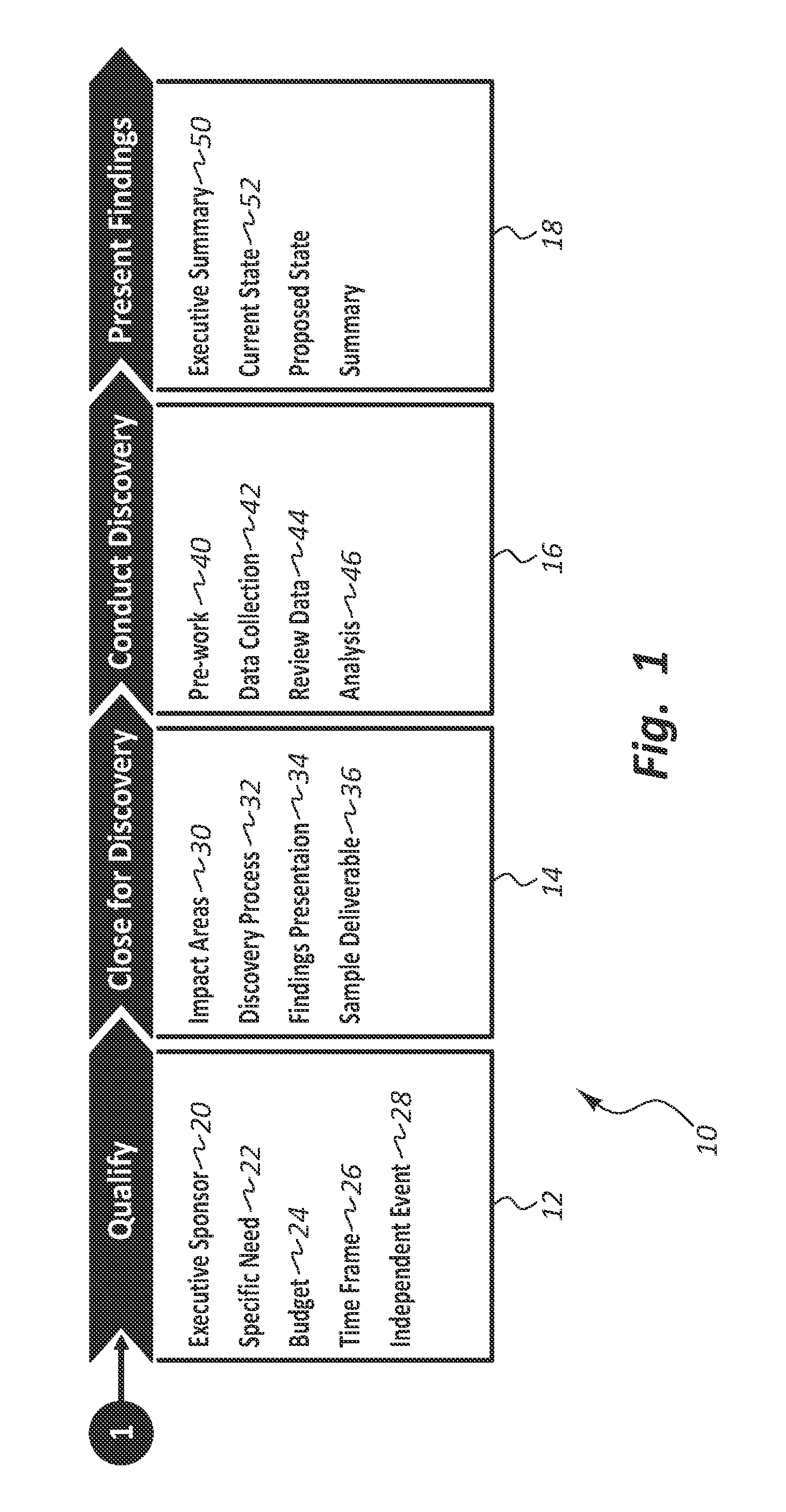

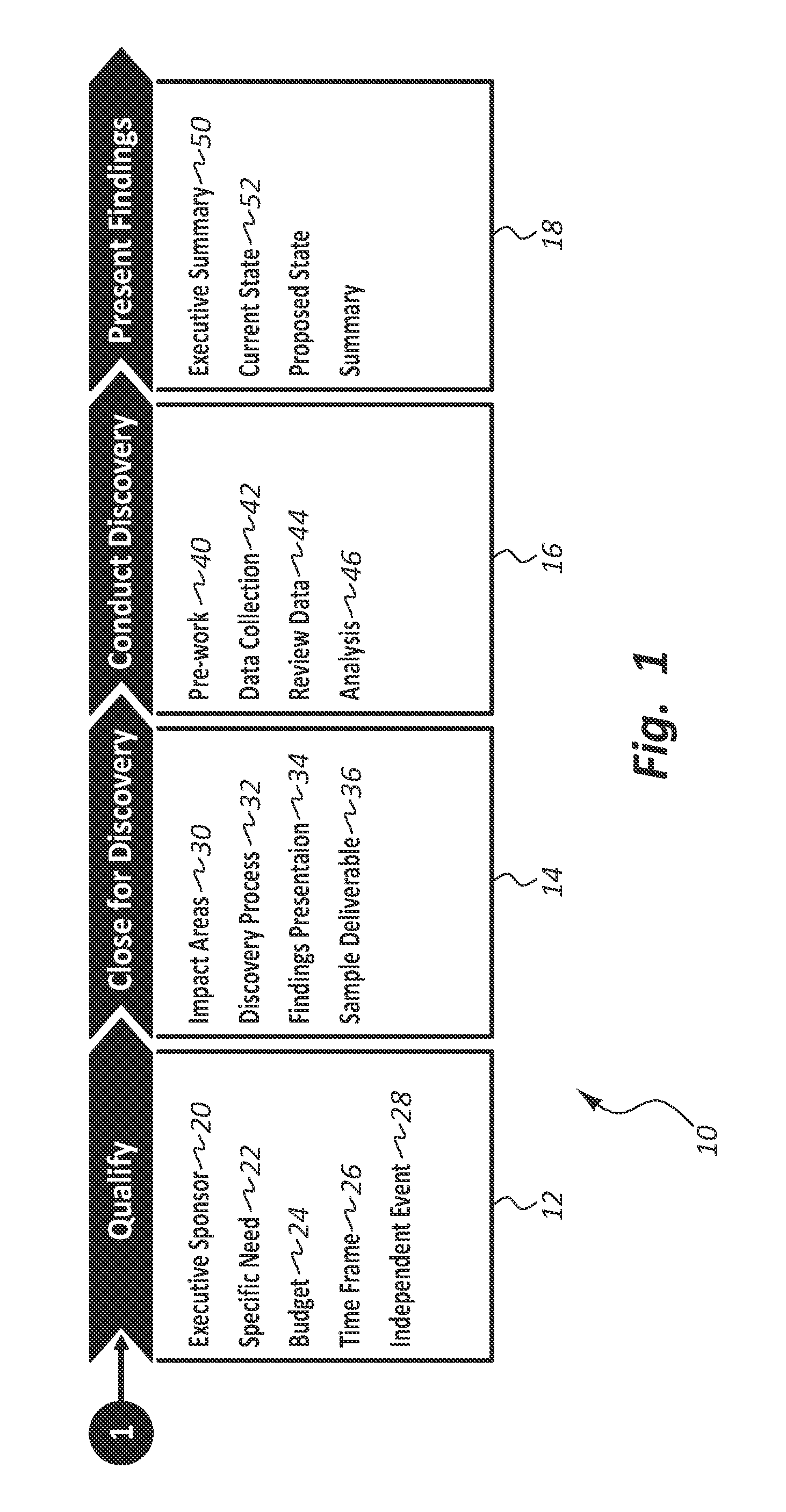

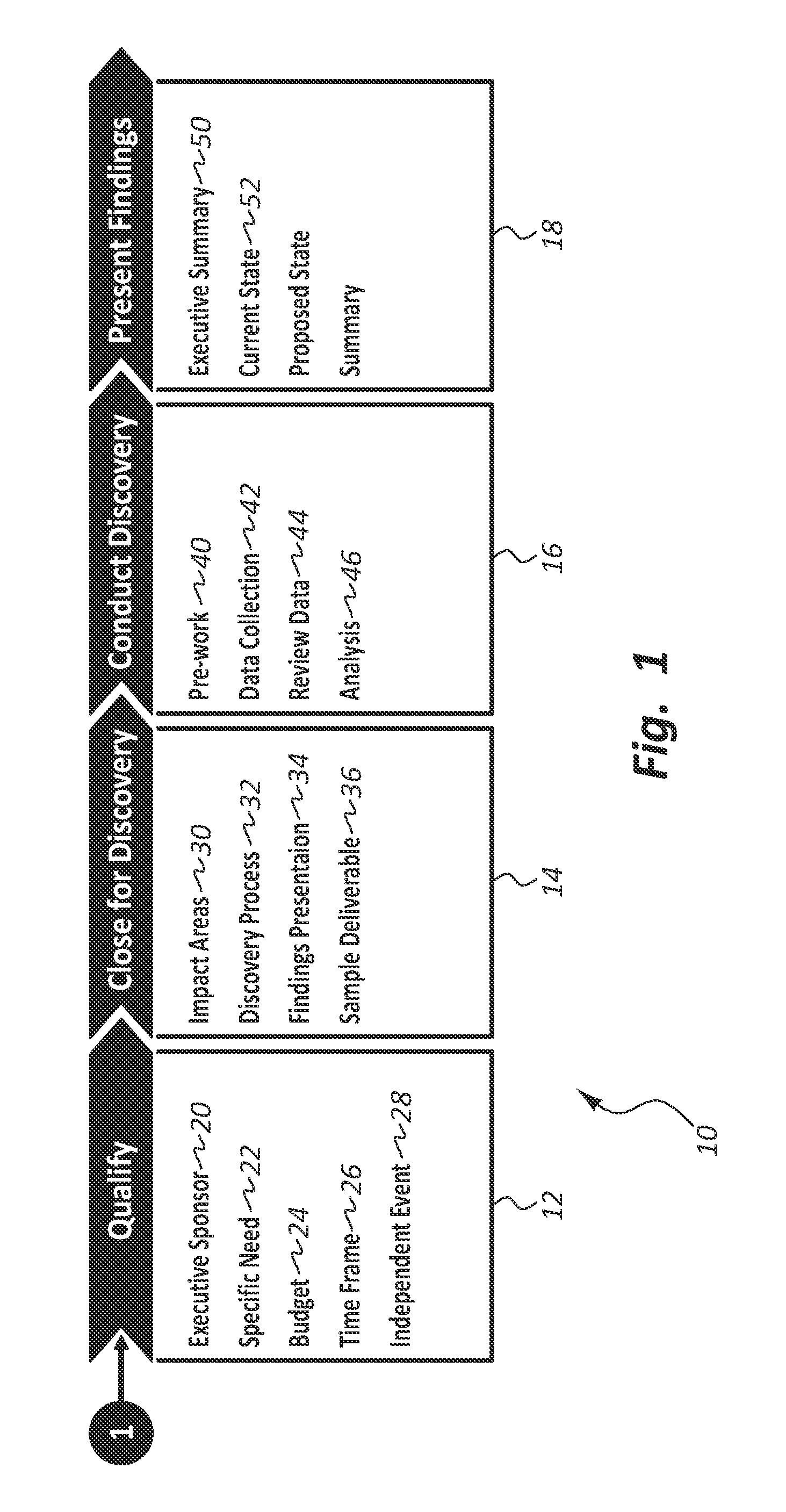

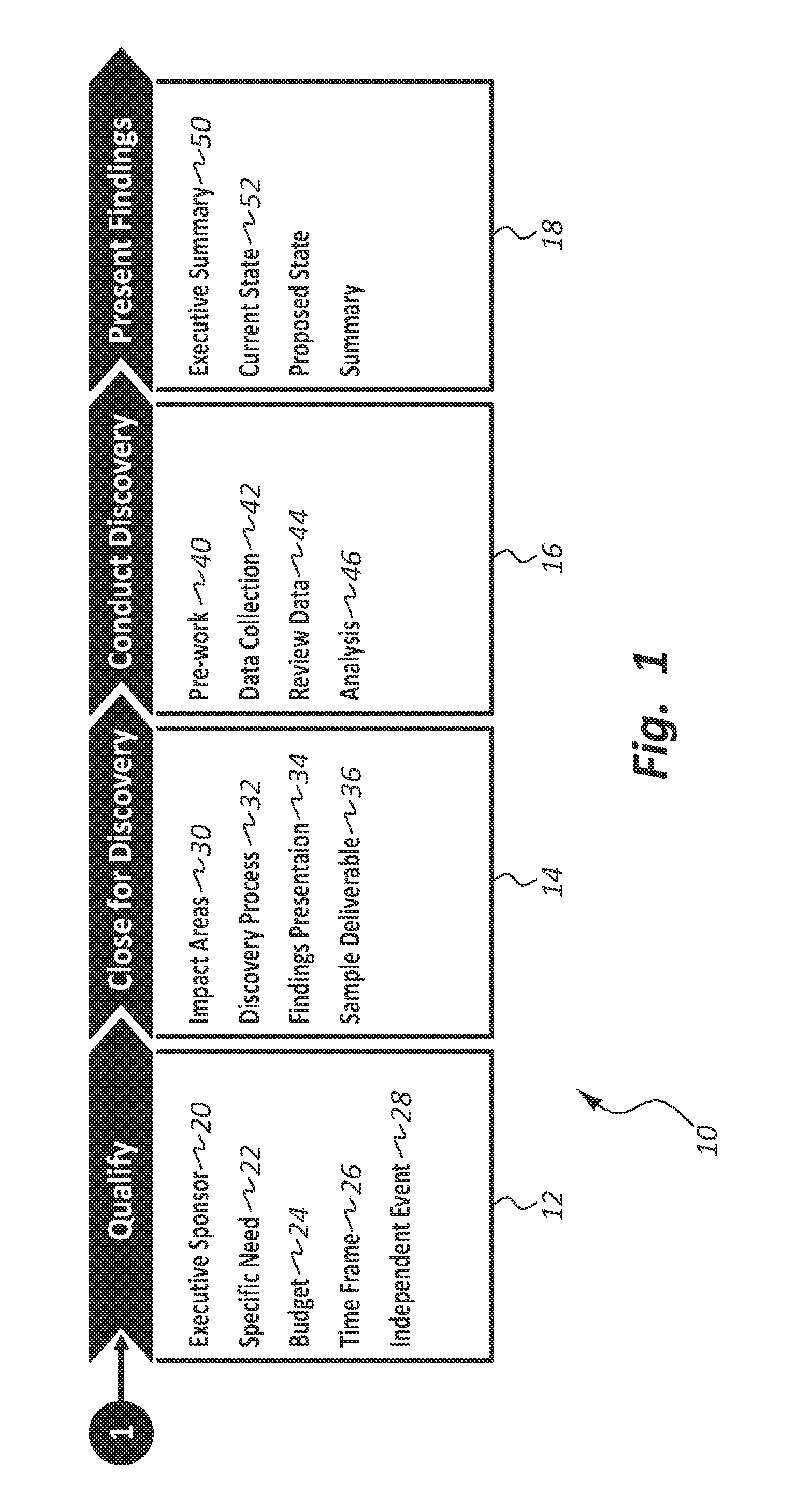

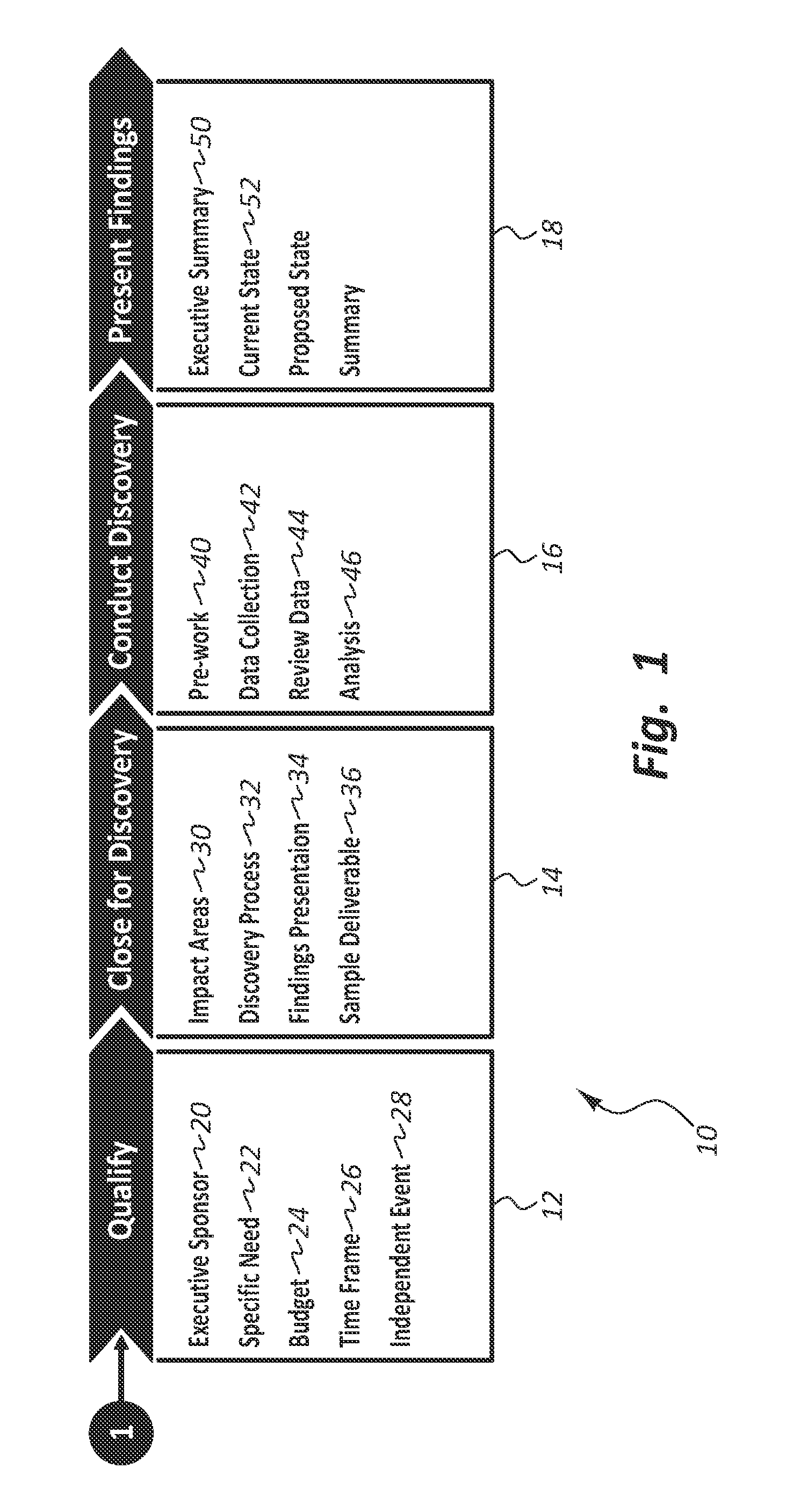

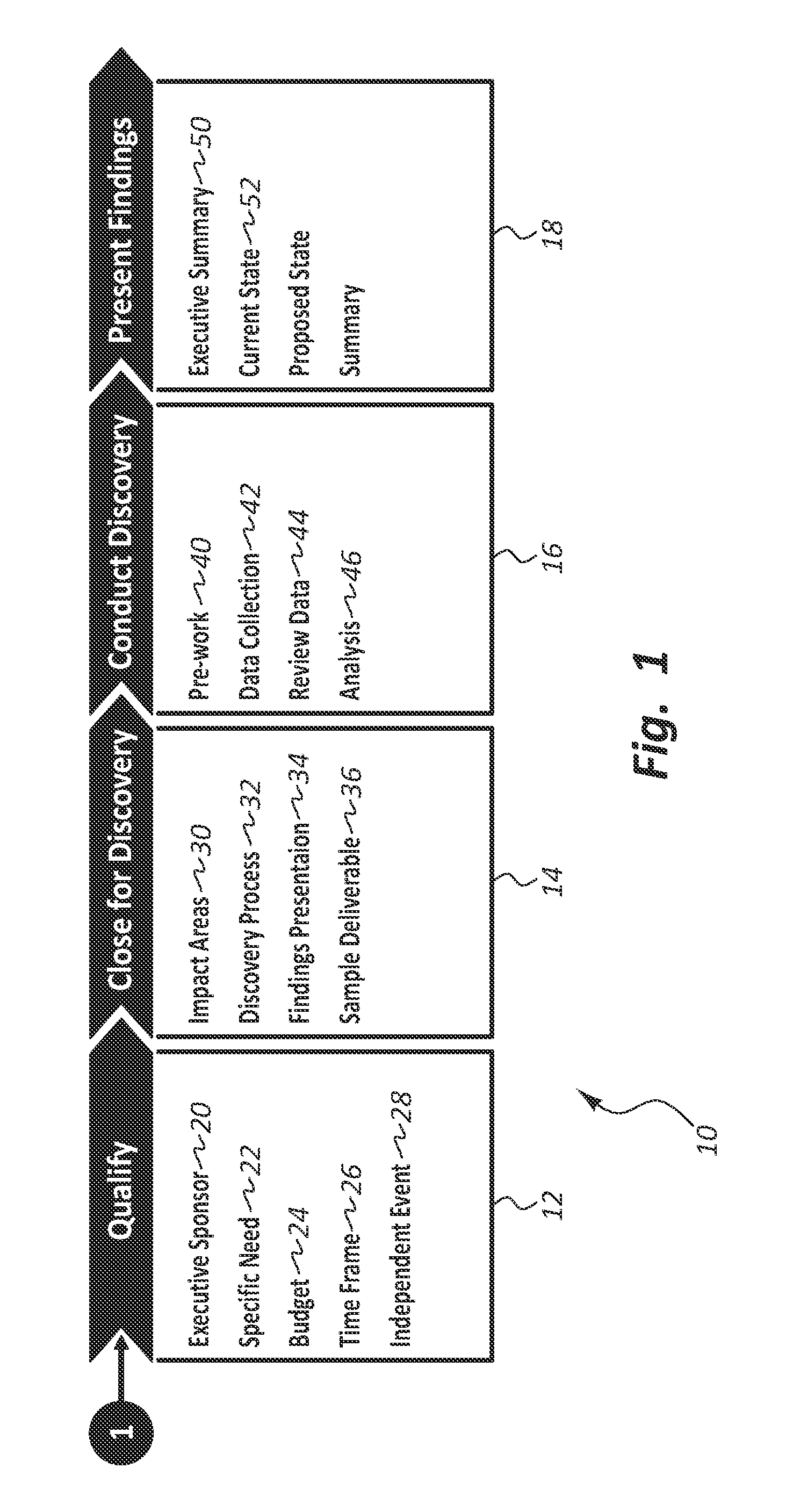

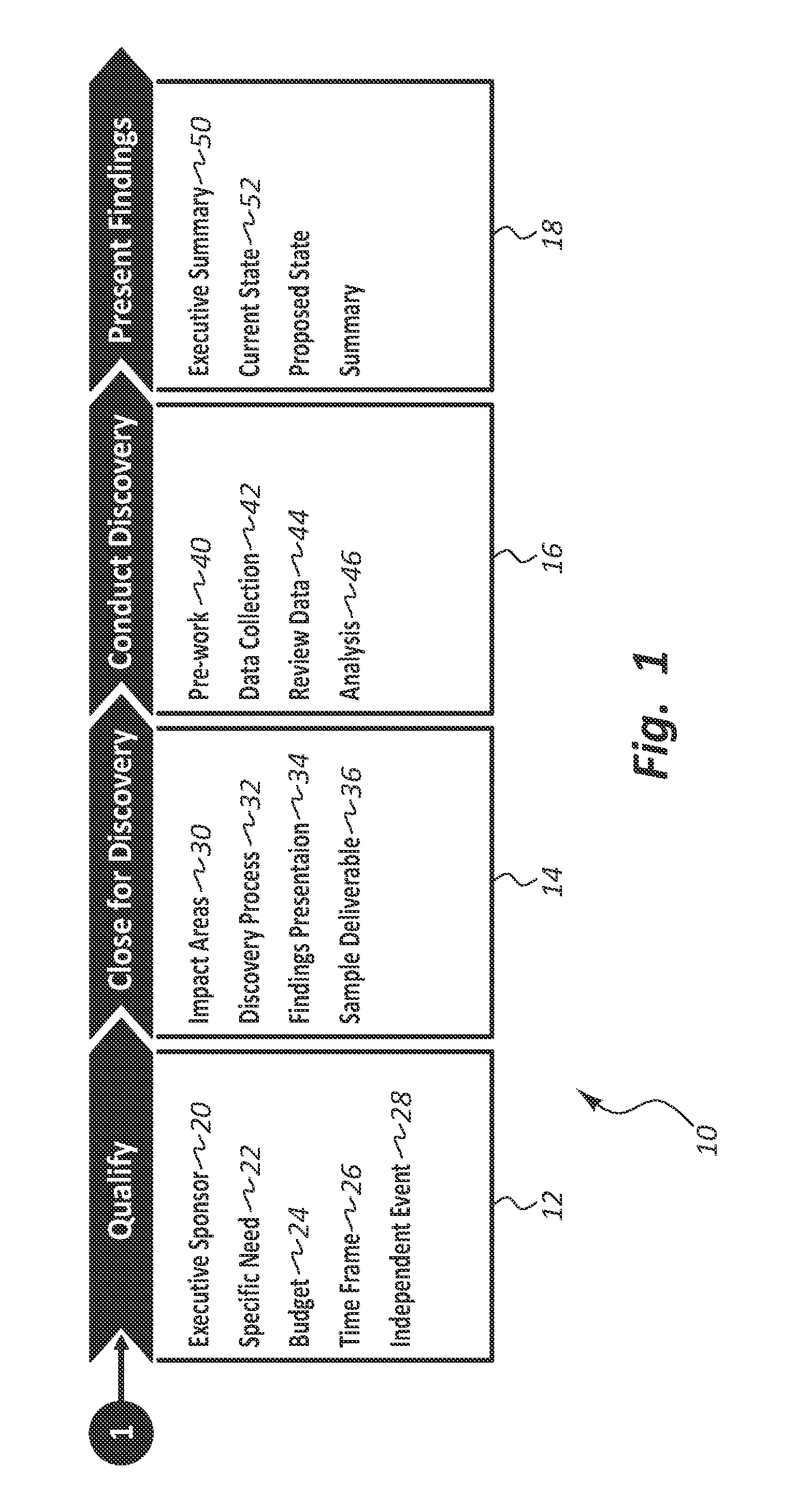

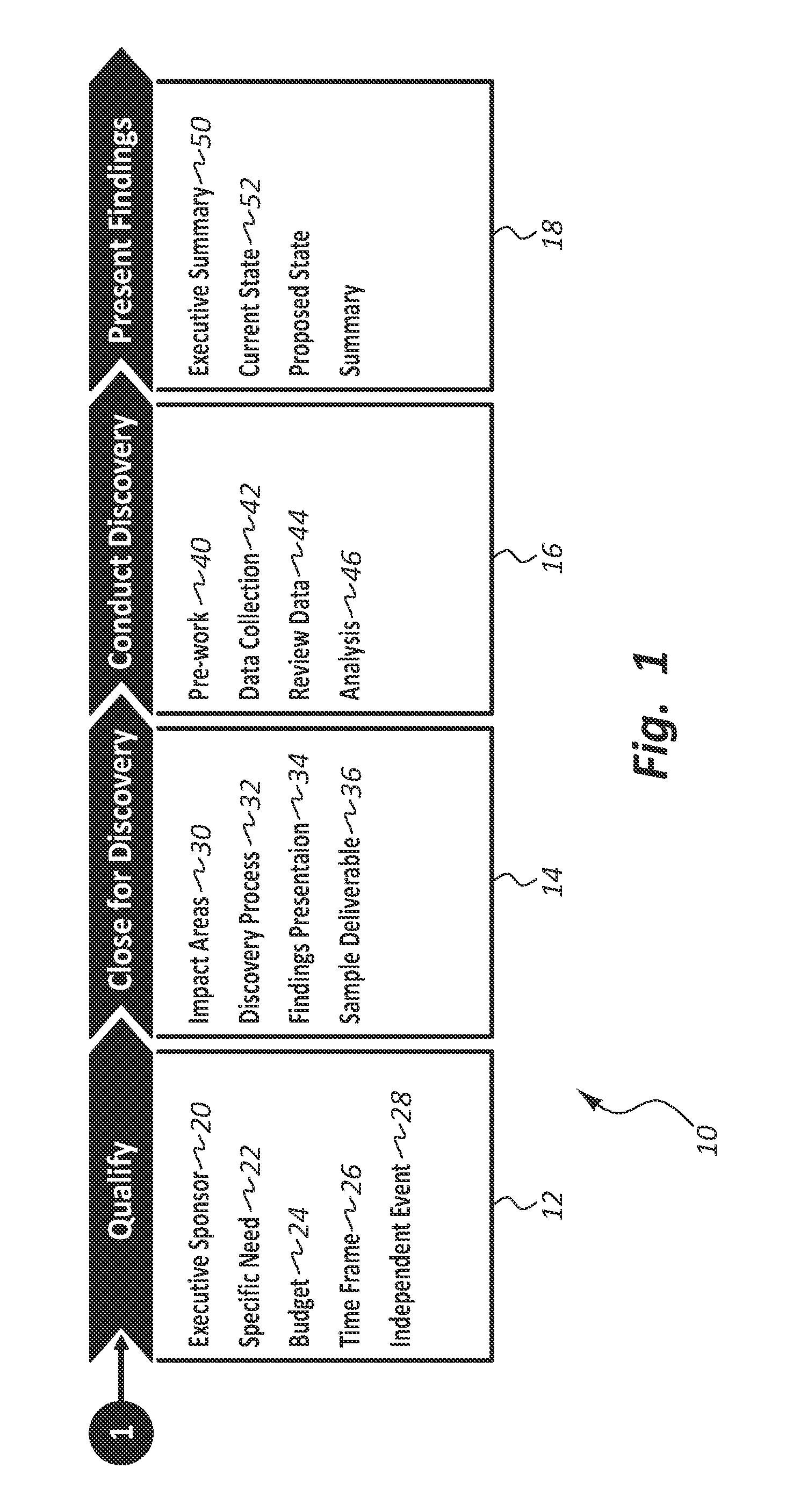

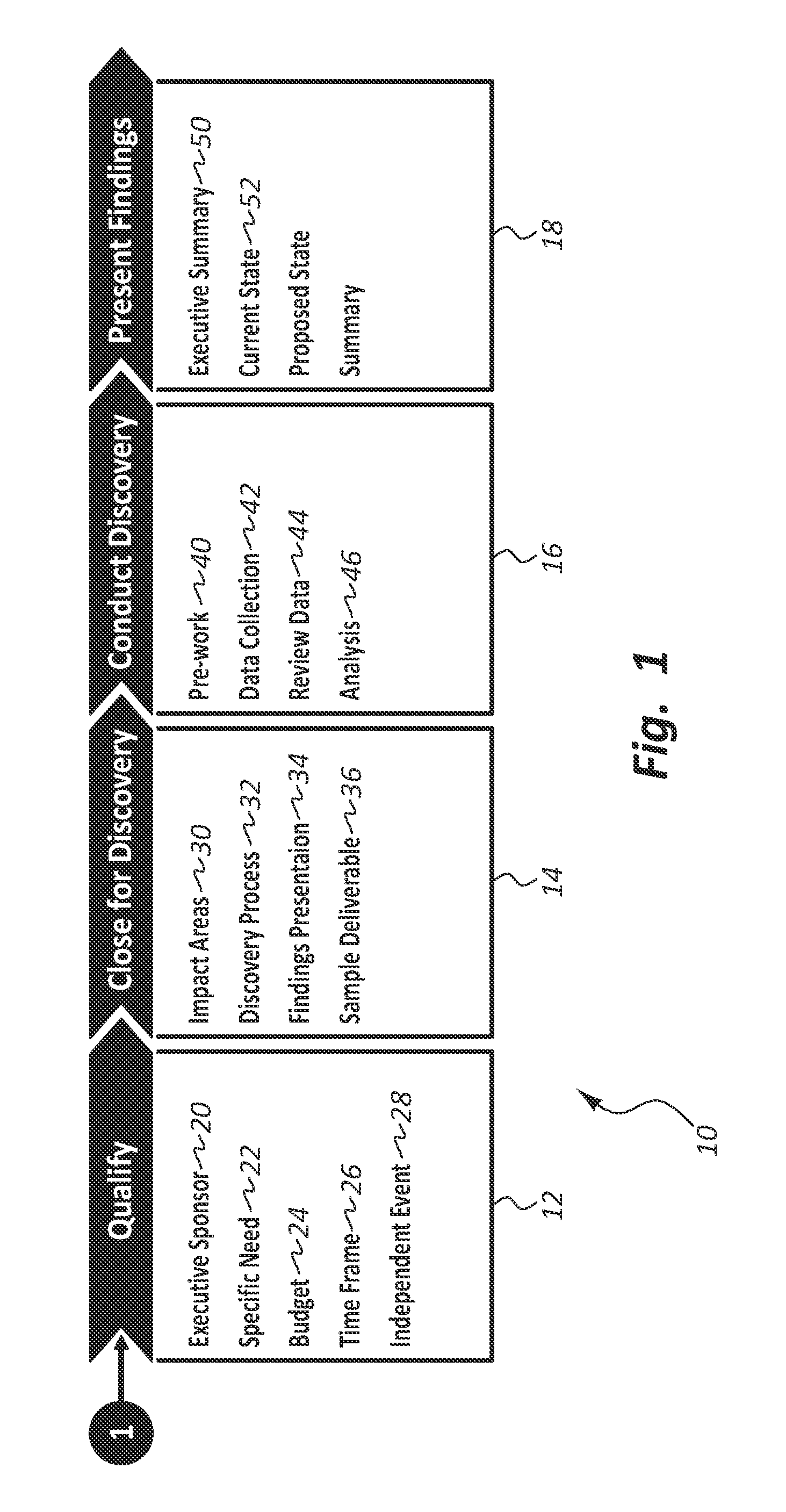

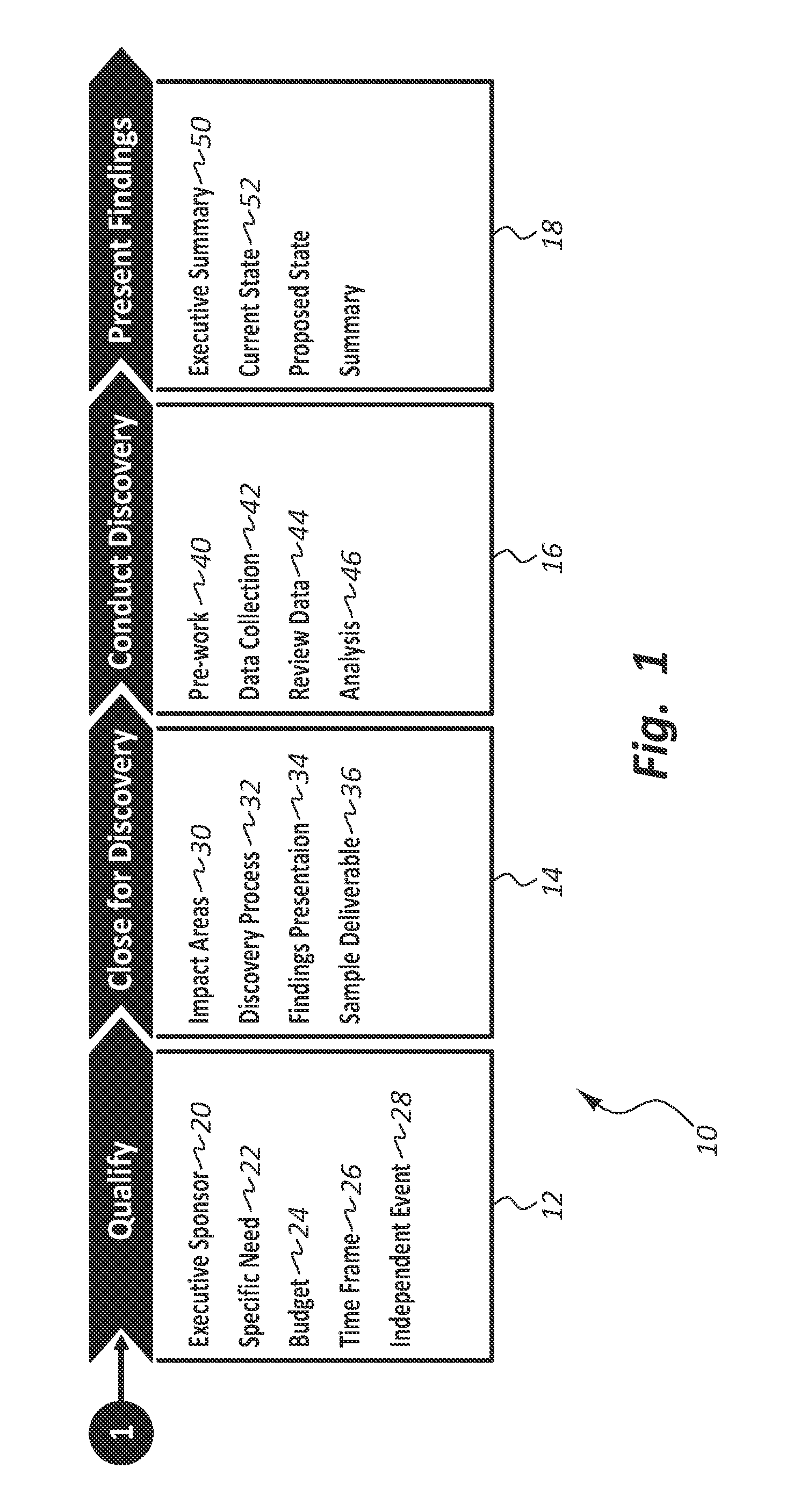

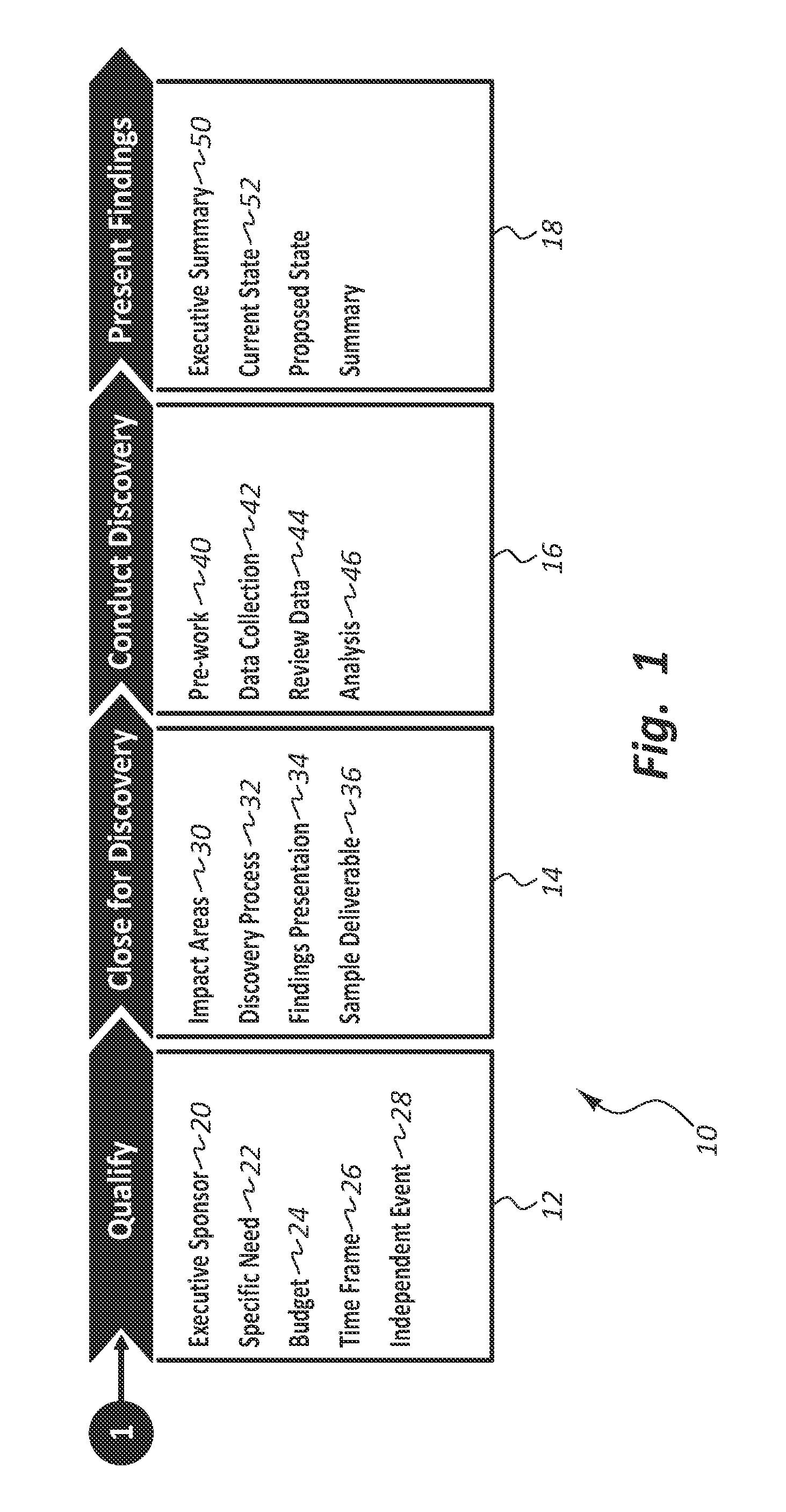

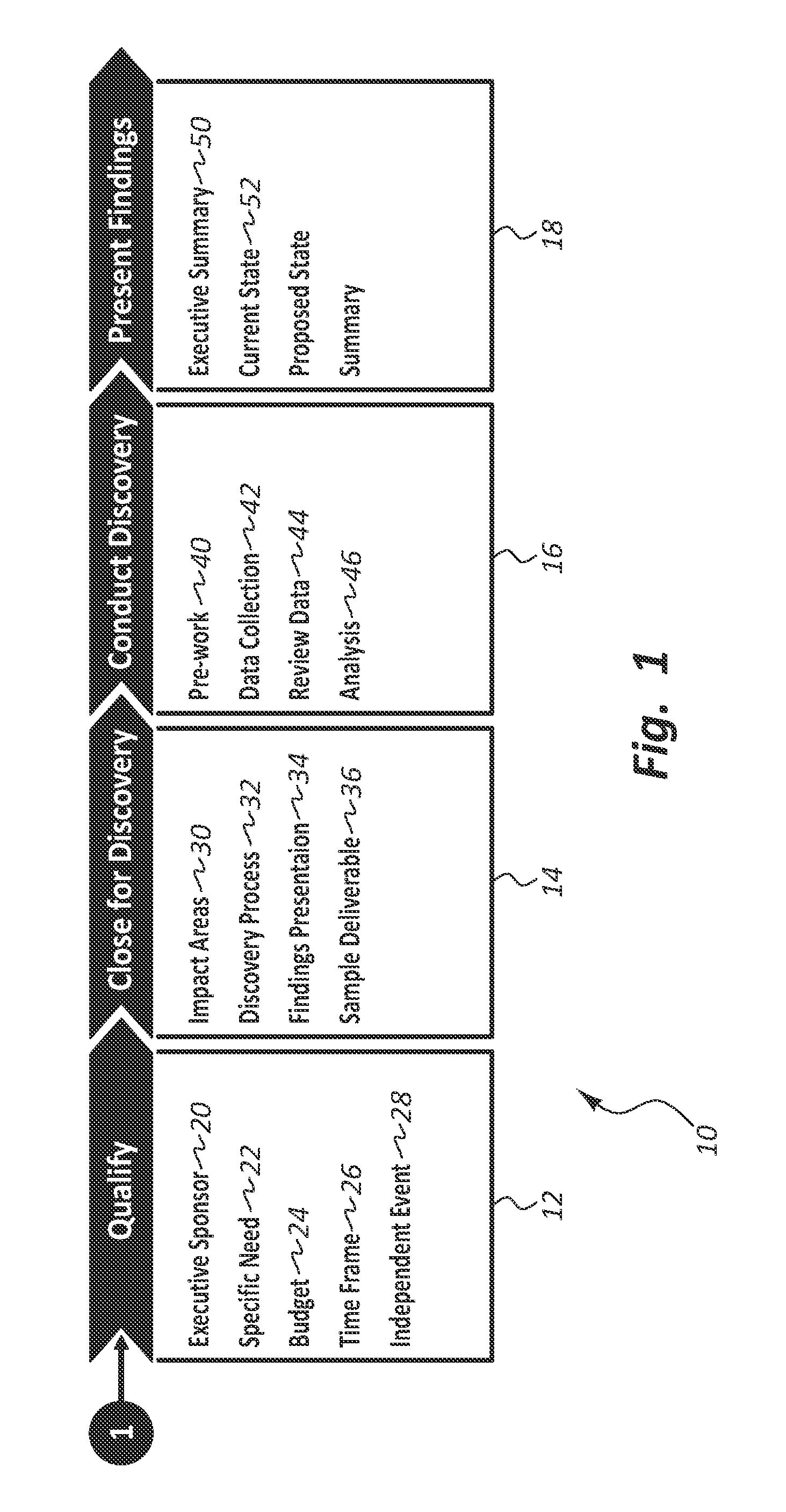

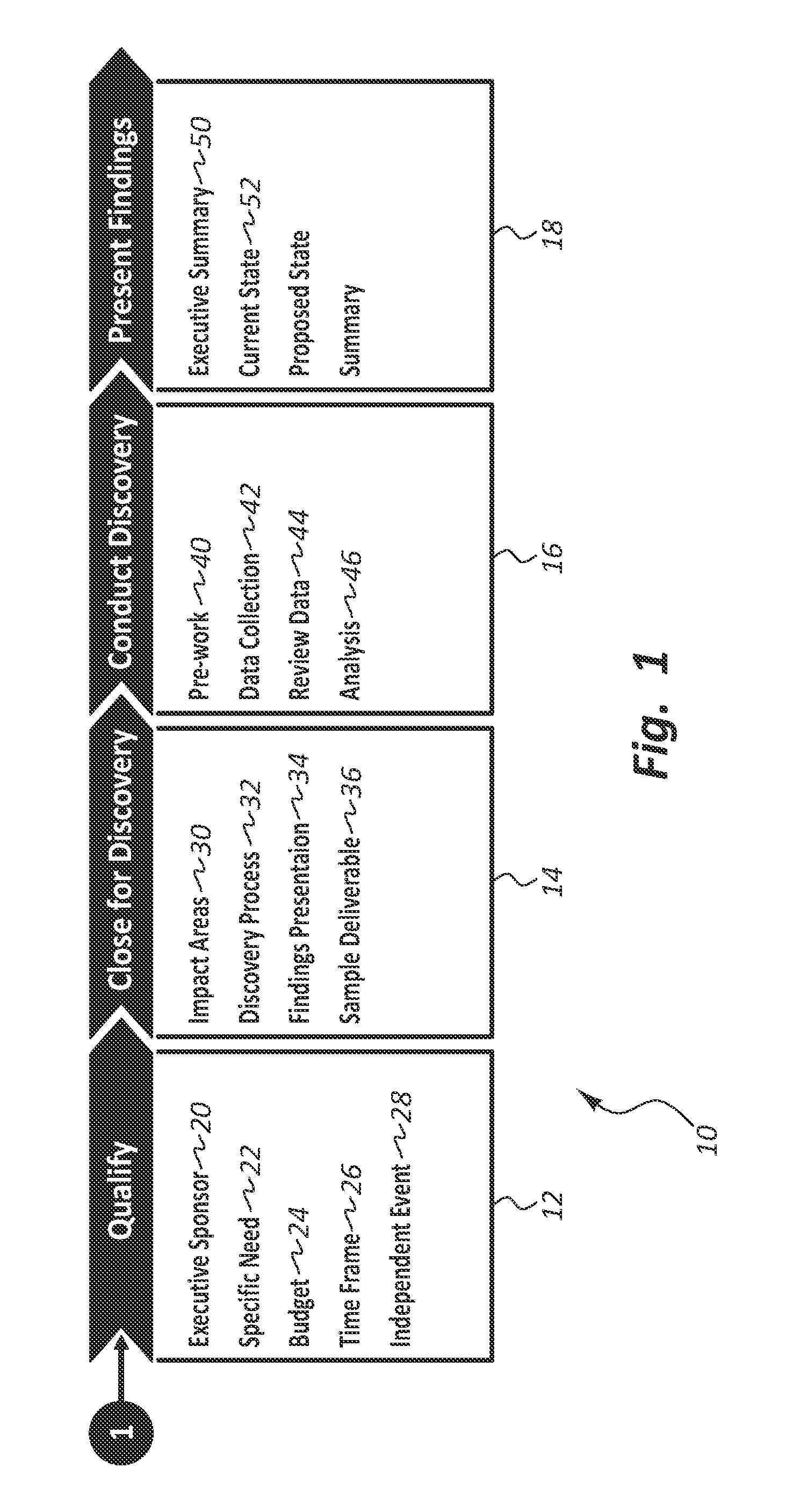

This application is a continuation-in-part of U.S. Provisional Patent Application Ser. No. 61/384,531 filed Sep. 20, 2010. 1. Field of the Invention The present invention relates to a process for effecting sales and more specifically to a program for selectively performing tasks to effect the sale of a product or service directed to a particularly technology or industry. 2. The Technology The success of many commercial enterprises depends on their ability to sell their products, whatever they are. Such products may cover the entire spectrum of commercial activity. The products can fall or be classified in a number of different categories or groups and also in a number of different ways that to some extent relate to the method or means for effecting sales. For example, consumer goods and industrial goods are two broad categories that each have unique and different ways to effect sales. Consumer goods are often sold in retail establishments visited by the consumer. Industrial goods are typically sold to the customer by a sales person/team. As another example, some industrial goods are “big ticket” products and services. The “big ticket” items (i.e., larger price and/or large size) also may be viewed or described as large production equipment and systems. The products and services may range in cost from thousands of dollars to millions of dollars. The kinds and types of “big ticket” items are way too numerous to list. By way of example and not limitation, the “big ticket” items can include industrial spray paint systems, industrial smelter ovens, CT Scan machines, injection molding machines, accounting systems, inventory management systems, packaging machinery, insurance/benefit programs, ore processing equipment, earth moving equipment, bottle filling equipment, municipal water treatment systems, chemical mixing systems, power generating equipment, and the like. In effect, a “big ticket” item is virtually any product, good, service, system or the like, that is normally sold by a salesperson or by a team of sales people and normally not at a sales place like a store or show room where sales staff interact with a customer who may have a team of people acting for or as the buyer. To effect sales of the “big ticket” items, one may typically expect a sales team from a commercial enterprise to interact directly with a customer. The team may be expected to go through a series of steps or actions to effect a sale. Information must be obtained on the needs of the customer and compared to what the seller has or can supply to meet those needs. While sales of “big ticket” items have been made for many decades, the process of selling has not evolved in any real or significant way. The customer's need is matched to what the seller has to offer or can modify to meet the need. The customer then decides whether or to make the purchase. Companies spend a lot of money to improve the effectiveness of their sales organizations by investing in sales training, marketing, sales force automation, literature, advertising, client entertainment, and the like. Notwithstanding all the investment to improve sales, most sales organizations struggle to make targets or goals. Many members of the sales teams are assigned quotas, and it is believed that only a small percent of attain and even fewer exceed their quotas. As part of a marketing program, messages are developed to announce and promote features and benefits of the product. Unfortunately, some of those messages are not grounded in reality. Further, the messages do not focus on the exact needs of the customer. In turn, messages about the product are believed to often be ineffective. Various kinds and types of sales training camps, sales retreats, sales seminars and other sales training programs are widespread; but their effectiveness is generally believed to be limited. In addition. customer tracking programs and similar electronic tools to automate the collection and sorting of sales information (e.g., leads and contact names and telephone data) are helpful in tracking leads and tracking selling activity. At the same time, these tools do not inform the sales team on what activity or action is needed for this customer that will lead to or is more likely to lead to a sale. It is also believed that some companies focus on specific sales tools such as specialized spreadsheets and return-on-investment (ROI) calculators. However, these tools focus on assumptions made about the use of the product as envisioned by the seller and not on real use or operations that are likely if the sale is effected. In some cases, it is believed that some tools are so complex, the salesperson is not likely to use the product or use it correctly. As a result, the tool leads to increased cost, but it is believed there is no corresponding increase in sales. From the above, it can be seen there is a need for methods and programs to organize the sales effort into one that is coordinated and tailored to the product and to a specific customer. A business process and a sales platform are configured for guiding a sales effort. At least one impact area for a customer is identified and targeted by a sales team promoting a product. At least one discovery tool is used for collecting information from the customer and for use to create financial impact models that uniquely convert data to cash flow terms. The data from the discovery and the calculations are presented in real time and may in some cases be manipulated or be deemed interactive in the real time in a presentation. In some cases, data from multiple sales efforts may be retained in various targeted workspaces for reuse when addressing a new customer. In most cases, the customer is first qualified. Thereafter the business drivers may be mapped in a system that has an architecture structured to retain the formats but allow data entry to change to create presentations relating to the use of a product for a customer. A model engine is provided in the system to present the financial factors, the business drivers and the impact areas to the customer visually and with an interactive capability. Discovery of appropriate information for the system may also be effected by creating web based interview guides, surveys and data sheets useful in automating the data collection process, which is used to perform an analysis of the customer's needs. Other engines may be used including a real time presentation engine and an animation engine for creating presentations for customers. In one arrangement, a computer system is assembled with a processor that may be remote and with terminals interconnected to transmit information to and from the processor. A display device may be connected to display information like real time presentations for a customer. The processor is preferably configured with a model engine to prepare models and with a real time presentation engine and an animation engine. Systems factors to tailor the presentation to the viewpoint of the customer may preferably target known business drivers as well as recognized financial impacts. Exemplary embodiments are illustrated in referenced figures of the drawings which illustrate what is regarded as an illustrative embodiment. It is intended that the embodiments and figures disclosed herein are to be considered illustrative rather than limiting. Reference will now be made in more detail to the illustrated embodiments of the present invention, systems and methods for a programmatic approach to sales execution. While the invention will be described in conjunction with the preferred embodiments, it will be understood that they are not intended to limit the invention to these embodiments. On the contrary, the invention is intended to cover alternatives, modifications and equivalents which may be included within the spirit and scope of the invention. Accordingly, embodiments of the present invention provide for a programmatic approach to guided sales execution based on business drivers, such that product or service benefits are organized around business drivers and not necessarily technological advances. Embodiments of the present invention can be implemented on a software program for processing data through a computer system. The computer system can be a personal computer, notebook computer, server computer, mainframe, networked computer (e.g., router), handheld computer, personal digital assistant, workstation, and the like. Other embodiments may be implemented through specialized hardware for purposes of implementing a programmatic approach to sales execution. This program or its corresponding hardware implementation is operable for enabling the integration of one or more applications supporting the completion or implementation of a work flow or process. In one embodiment, the computer system includes a processor coupled to a bus and memory storage coupled to the bus. The memory storage can be volatile or non-volatile and can include removable storage media. The computer can also include a display provision for data input and output. In other and more typical applications, multiple computers are interconnected to, by and to form a network to provide for communication of data between computers and in turn to effect communication between users to allow for input from different users and out put to different users. Some portions of the detailed descriptions that follow are presented in terms of procedures, steps, logic block, processing, and other symbolic representations of operations on data bits that can be performed on computer memory. These descriptions and representations are the means used by those skilled in the data processing arts to most effectively convey the substance of their work to others skilled in the art. A procedure, computer executed step, logic block, process, etc. is here, and generally, conceived to be a self-consistent sequence of operations or instructions leading to a desired result. The operations are those requiring physical manipulations of physical quantities. Usually, though not necessarily, these quantities take the form of electrical or magnetic signals capable of being stored, transferred, combined, compared, and otherwise manipulated in a computer system. It has proven convenient at times, principally for reasons of common usage, to refer to these signals as bits, values, elements, symbols, characters, terms, numbers or the like. The term “products” is used herein to refer to anything that one can sell including services, software, financial products, machines, vehicles and insurance. The term “big ticket” typically refers to something that has large value in proportion to the business. Thus a $3000 All Terrain Vehicle (ATV) would be a relatively minor purchase for very large corporation (sales revenues in excess of $1 billion) and a huge purchase for a very small company (sales revenues under $100K. The considerations in making the decision to buy could be quite similar, but staffing and management involvement could be quite different. Of course “big ticket” typically means and includes purchases of products the value of which can extend from perhaps around $100,000 USD to well above $10 million USD (e.g., a large jet airplane); but at the same time, it can also mean a relatively modest purchase involving a few thousand dollars which is sold for use in the production of income or other value. It should be borne in mind, however, that all of these and similar terms are to be associated with the appropriate physical quantities and are merely convenient labels applied to these quantities. Unless specifically stated otherwise as apparent from the following discussions, it is appreciated that throughout the present invention, discussions utilizing terms such as “determining,” “creating,” “storing,” or the like refer to the actions and processes of a computer system, or similar electronic computing device, including an embedded system, that manipulates and transfers data represented as physical (electronic) quantities within the computer system's registers and memories into other data similarly represented as physical quantities within the computer system memories or registers or other such information storage, transmission or display devices. Further, throughout the Application, the term “database” may be used to describe a location for storing information or data, and/or a mechanism for storing information or data. As such, “database” is interchangeable with the storage, data store and similar terms. Sales efforts to sell “big ticket” products prior hereto have typically included or focused on the “return-on-investment” (“ROI”) to the customer. That is, the value or cost to purchase the “big ticket” product or service would be compared to a financial model involving its use and the benefit obtained as a result of the purchase and use of the “big-ticket” product such as, for example, reduced labor cost, increased production; lower use of raw materials, and/or other comparable factors which can be quantified to show a financial benefit to be realized by the customer. While ROI was and still is certainly a factor of import to some if not many customers, it has been determined and is heretofore not been appreciated by sales personnel and sales teams that the focus must be shifted to both a total financial analysis coupled with a showing on how the “big ticket” product supports the business drivers of the customer. That is, the inventor has discovered that nearly every company will focus or look at the connection of the “big ticket” product to its business drivers that include growing revenue, controlling (e.g., lowering) costs, retaining customers and increasing work force productivity. As to the financial factors, the purchaser today looks for a lot more than ROI and is now looking at a total a financial analysis that involves the following factors: the amount of the investment; the cash flow generated by the “big ticket” product; the net present value (NPV) created by making the investment; the total return by making the investment; the payback period; risk factors (e.g., a long pay back period increases the risk of market change that could have a negative impact on the expected financial rewards projected at the outset; and an elasticity analysis (i.e., how changing an economic variable affects other variables). To proceed in a way to address the business drivers and to complete an analysis of the financial factors, one must proceed in a particular way to ensure that the analysis should be undertaken and if so how to collect the information needed to complete the analysis. Embodiments of the present invention provide for a web based interactive process model to define the sales process. That is, a user obtains firmware including a computer configured with programs and such other accessories so the user is able to connect to the world wide web (WWW) and to thereupon connect to a source accessible through the web to obtain a program that takes the user through specific steps or processes to complete the desired analysis. Alternately, one may obtain a computer or computer system with one or more stations or terminals and with access to programs and other accessories through or using the world wide web. Alternately, one may have a disc or flash drive that contains the desired program(s). As seen in Qualification 12 is a very important step. A sales executive must first be identified 20 as the customer who supports the sales effort. The executive broadly looks at the “big ticket” product in correlation to the business of the customer to determine if there could be or is a specific need 22. If “no” or “not,” the sales lead is disqualified and the matter is closed. If “yes,” the sales executive 20 will provide enough information so the sale team may thereafter develop a budget 24 (e.g., travel to the customer's offices, testing, cost to conduct other discovery for effecting the sale as well as setting out a time frame 26 for completing a sales effort. Typically one will also look for an impending event 28 that would allow the benefits of the “big ticket” product to be demonstrated or confirmed. To close for discovery 14, one secures approval from the executive 20 of the customer to proceed with discovery because the lead or customer has been initially qualified. The impact areas 30 for the “big ticket” products need to be carefully evaluated along with the selection of a suitable discovery process 32 and then the selection of a suitable or desired form or type of findings presentation 34 (discussed subsequently). Also a determination is made if and how and when a sample could be delivered 36 to the customer or other steps taken to demonstrate the “big ticket” product. To conduct discovery 16, a sales team will setup the project (pre-work) 40, contact the customer to collect data 42 with the support of the executive 20 including going on site to observe operations. Thereafter, the sales team will review and analyze the data 44 and 46 and then assemble it or process it into the findings presentation. The sales effort is completed by presenting the findings 18 to the sales executive 20 in the form of an executive summary 50 (detailing the overall impact), outlining the current state (how things are done today) 52, providing a proposed state (recommendations to improve the business) 54 with a focus on the business drivers. And finally, a financial summary is presented reviewing the financial factors and in turn the benefits of the “big ticket” product. To take the user(s) through the steps 2-5 of Business Driver Mapping Business driver mapping is better illustrated in In a similar fashion, the productivity 68 business driver shows that the telephone call processing system will lead to lower handling time 74, preempt 76 other activity by sales personnel or operators that reduces productivity, provide operators with self service 78 and in turn lead to virtualization 80 for some due to included automated calling. The retention 66 driver shows that the buyer or customer acquiring the theoretical call processing system will want to keep it because it presents a long term value 82 and will be a good experience 84. In turn, the cost control 64 driver shows that purchase of the “big ticket” telephone call processing system leads to lower overall cost 86. It may be noted that in Turning now to The platform architecture is seen in In To interface with the various workspaces 112, 114, 116, and 118 in the computer system of the user configured to operate as herein disclosed, a user will call up and access the screen 130 a sample or example of which is illustrated as Turning now to the model engine earlier identified, it uniquely has been created to replace and avoid use of a common tool used to present data referred to as a “spreadsheet.” Each spreadsheet is typically designed for each specific use to present data in a tabular or columnar form to show relationships. For business drivers, the impact areas will vary from customer to customer and from product to product so that a standard spreadsheet is not available. Only skilled users and operators are able to assemble or put together complex spreadsheets with complicated relationships. The model engine that is incorporated into the illustrated and disclosed system uniquely presents and processes data that shows cash flows for each impact area, supports virtually an unlimited series of models, and creates a “snap together” system that allows financial models to be assembled much like building blocks. Further, the model engine incorporates functions that allow the system to reflect changes in cash flow in real time. The cash flow model 154 has a model interface 162 and model input function comparable to the real time financial model. The cash flow model senses or reads changes in financial models in the real time presentation. Any changes in the financial models are reflected in real time in the cash flow model. The business case model 156 senses or reads changes in cash flow emanating from the cash flow model 154, which are then reflected in the business case model in real time. The business case model 156 also has a model interface 166 and a model input 168. The real time model 152, the cash flow model 154 and the business case model 156 each are connected to a database 170 typically in parallel so that each model may directly access the data used by them. Each can be connected or disconnected by any suitable means (e.g., a key stroke) that allows the user to add or subtract models at will and in effect snap them in and out of the system so they are like or can be visualized to be comparable to building blocks. The model engine also includes a slide template library 172 which houses all the various models of slides used in the system. Users can call up the models (in, for example, the user's workspace; see Turning now to The real time interactive model 180 supplies data to a mathematical processing step 186. The model calculations have been developed and preloaded to calculate specific data like total sales or total units as discussed hereinafter. Once the model calculations are developed, the model developer tests the model calculations 188 to make sure it is presenting financial data and key metrics in real time and to update with changing data. The developer may test in different ways to make sure that the calculations that are preloaded into the model or slide are correct. For example the developer of the model may create a graph or chart to see if the data fits an expected result. If the test calculation 190 are satisfactory, then the model is next configured to accept model inputs 192. For each interactive model, the model inputs 192 are linked to a model interface 194 that is much like model interface 182. The data is then assigned 196 to a model type such as the model it supports. Such a model may be a financial model, an animation model, and the like. If the data is sensed to be financial, then the model being developed will be configured so that the financial data will be accessible to other financial models and will appear in a tree 198 or location which in effect determines where it will appear within the system for access and use by users preparing a sales presentation 18 for a customer. A model domain 200 has been created and is used to filter the data so that it will match or fit a template when the user is looking for or selecting a desired template. Thereafter, the various models that have been created are configured so they can be assigned to a client account 202 for access and use in connection with that account and the related presentation of findings 18 ( To better understand how the model engine discussed herein above operates, let us assume that a proposal is made for a telephone call processing center similar to that discussed hereinbefore. The close rate comparable to close rate 68 is an impact area for the growth business driver 62 (see Data input boxes 238 that are presented when one selects “edit slide” in the tool bar 234 are shown in In furtherance of the example involving a telephone call processing system as hereinbefore presented, As earlier stated, the model engine translates each impact area into a single function that expresses benefits in terms of cash flow. Thus, a change in the rate of closing sales or shortening the time to complete a sale can translate into cash flow. To shorten the sales cycle for a “big ticket” product and in effect complete the sale faster, a credible business case must be presented. As earlier mentioned the financial factors of a good business case include the amount of the investment; the cash flow generated by the “big ticket” product; the net present value (NPV) created by making the investment; the total return by making the investment; the payback period; risk factors (e.g., a long pay back period increases the risk of market change that could have a negative impact on the expected financial rewards projected at the outset; and an elasticity analysis. The role of the business case model is to capture the cash flows from the various cash flow models (for that presentation). A presentation may have multiple cash flow models that are used to summarize and visualize the business drivers for different areas of the customer's business. The business case model may roll up the different cash flow models to form the business case. Additionally, one presentation can include multiple business case models. The NPV is applied to the Net Cash Flow 328 to yield the NPV of the cash flow, which translates cash flow received in the future into today's dollars. A calculation is also made to show the internal rate of return (IRR) 334 and the number of months for payback 334 which is the time it takes to recover the investment 322. The business case model of As noted in connection with As an improvement and additional feature, the real time presentation can include animation that is generated by an animation engine in the computer system. When the user goes to create an animation, the asset will appear in the asset browser in the location specified by the developer. The user can include the asset in the animation and access the functionality of the asset, e.g., make a call. The user cannot change an asset, they can only access inherent functionally created by the developers. An external animation engine 384 is selected for use with the asset 386 to create an animation the user can manipulate 388. As better seen in Automated discovery may be undertaken to collect data and facts from the customer that relate to the “big ticket” product to be sold. A wide variety of web based tools and programs are now available to collect information about markets, industries, and customers. In addition, information may often be provided by the customer when asked to support the sales presentation. It is presently contemplated that at least one discovery tool will be created that is used for collecting information from one or more customers, in general. The discovery tools may include interview guides, data sheets, surveys, and other tools to gather needed information to assess the process or operation into which the product will be integrated. Further, the discovery tools may be customized to a targeted customer. In addition, the collected information supports use of the financial impact models as applied to the targeted customer. Although implemented through a web based form, collection of information is supported through any information gathering and collection process, to include the use of stand-alone systems and the like. The discovery function or process also includes a task list builder, a sample of which is shown in One discovery task may include steps to identify those who are stakeholders in the decision making process. The above discussion should illustrate that the present invention is contemplated to be embodied in a system that involves “cloud” computing which is also known as Software as a Service (SaaS). So for example, the entire system being discussed may be hosted in Tier 4 datacenter. Users access the system via a Web Browser. Google Chrome is a preferred system, but the system herein disclosed will work with any modern browser. Once the cloud system is accessed, it can be seen that data is input by the user and that data is sent to the remote site where the computations are undertaken with the resulting data supplied back to the user. In summary, the system herein disclosed delivers a systematic and programmatic approach to guided sales execution that enables a sales team to proceed more logically through the sales cycle. The approach includes building a portfolio strategy for a technology or industry; sales process development; training; and mentoring. The entire approach creates sustainable behavioral changes within the sales team to drive improved sales performance. Accordingly, embodiments of the present invention provide for a programmatic approach to guided sales execution. Other embodiments of the invention provide the above advantage and further develops a system strategy based on business drivers and financial factors such that the benefits of the “big ticket” product or service are organized around business drivers and financial factors important to the customer and including ROI but separate from reliance on simple technological advances (it does it better/faster/cheaper). Still other embodiments of the present invention provide the above advantages and further provide for a system that facilitates collaborative collection of information related to a targeted company and building of a presentation touting the benefits of a product or service based on business drivers and financial factors to the targeted customer. A system and method for a programmatic approach to guided sales execution is thus described. While the invention has been illustrated and described by means of specific embodiments, it is to be understood that numerous changes and modifications may be made therein without departing from the spirit and scope of the invention as defined in the appended claims and equivalents thereof. Furthermore, while the present invention has been described in particular embodiments, it should be appreciated that the present invention should not be construed as limited by such embodiments, but rather construed according to the below claims. The approach is applicable for any type of sales that involves data collection, financial modeling, business case creation, and executive presentations. In addition, the approach is applicable for sales directed to the offering of any product and/or service but more particularly to “big ticket” sales. For instance, the approach is applicable to the sale of any product or service in any technology or industry, such as electronics, automotive, software applications, raw materials, etc. More specifically, one programmatic approach is designed to be directed to a group of customers that all belong to the same technology or industry. As such, the overall approach is globally suited to that particular technology or industry, and furthermore can be tailored to a targeted customer within that group, such that implementation of the programmatic approach is directed to the targeted customer for purposes of sales execution. The present invention relates to systems and methods for providing a programmatic approach to guided sales execution. More particularly, the system includes an Executive Engage platform that further includes an impact area model builder, a financial impact model builder, a discovery engine, and an interactive sales process model builder. The impact area model builder is configured for determining at least one impact area for a related group of customers potentially targeted by a sales team promoting a product or service. The financial impact model builder is used for creating a financial impact model for each impact area, wherein the financial impact model shows a beneficial financial impact on the impact area when using the product or service. The discovery engine is configured for creating at least one discovery tool used for collecting information from one of the group of customers to support use of the financial impact models. The interactive sales process model builder is configured for building a business case showing at least one benefit of the product or service to a targeted customer based on the financial impact models created for each of the impact areas. 1. A method for sales execution, comprising:

determining at least one impact area relating to the business of a customer and arising from use of a product being offered for sale to the customer;

creating at least one discovery tool used for collecting business information from and about said customer and about the impact of the use of product on said business; creating at least one financial impact model showing a financial impact in terms of cash flow on said impact area when using and not using said product; and creating a real time presentation showing said financial impact model when using and not using said product. 2. The method of 3. A method for effecting sales of a product, said method comprising:

identifying a target customer;

mapping the business drivers for the target customer to identify impact areas; developing the financial factors for the target customer and the product; and presenting the financial factors, the business drivers and the impact areas to the customer. 4. The method of 5. The method of 6. The method of 7. The method of 8. The method of 9. The method of 10. The method of 11. A method for effecting sales of a product, said method comprising:

identifying and qualifying a target customer;

mapping the business drivers for the target customer to identify impact areas including retention, productivity, growth, and cost control; developing the financial factors for the target customer and the product; and presenting the financial factors, the business drivers and the impact areas to the customer. 12. The method of 13. A method for effecting sales of a product, said method comprising:

identifying and qualifying a target customer and conducting discovery to collect data relating to the use of the product by the target customer; mapping the business drivers for the target customer to identify impact areas; developing the financial factors for the target customer and the product; creating interactive financial models for the business drivers and the financial factors; and creating a real time presentation to present the financial factors, the business drivers and the impact areas with and without the product. 14. A method for effecting sales of a product, said method comprising:

providing a computer system with at least one terminal having a screen visible by the user; identifying a target customer and operating said computer system to conduct discovery of and about said customer; operating said computer to map the business drivers for the target customer; developing the financial factors for the target customer and the product and related impact areas;

operating said computer to convert each impact area into a cash flow number; operating said computer to create interactive financial models for the business drivers and the financial factors using the cash flow from the impact areas; and creating a real time presentation to present the financial factors, the business drivers and the impact areas with and without the product. 15. The method of 16. The method of 17. The method of 18. A business process comprising:

identifying a product to be sold; identifying a customer having a business; developing the business drivers of the customer; discovering business information about the customer; comparing the product in use and not in use within the business of the customer; calculate at least one a financial impact model in cash flow terms; and visually presenting a business case to purchase the product to be sold using said financial impact model and the business information. 19. The business process of 20. The business process of 21. A computer system comprising

a processor for processing information, said processor including a memory and means for communicating information to and from the memory;

at least one terminal connected to said processor and operable by the user to communicate information to and from said processor, said terminal including at least one screen to visually display information for observation by a user and one input device for inputting information for communication to said processor, said terminal being operable to communicate the definition of at least one impact area relating to the business of a customer and arising from use of a product being offered for sale to the customer, said terminal being operable to cause said processor to create at least one discovery tool used for collecting business information from and about said customer and the impact of the use of product on said business, said terminal being operable to cause said processor to create at least one first financial impact model showing a financial impact in terms of cash flow on said impact area when using and not using said product based on said business information, and said terminal being operable to cause said processor to create a real time presentation showing said first financial impact model when using and not using said product; and a display device connected to said processor and said at least one terminal, said processor and said terminal being operable to cause said real time presentation to be displayed for observation by said customer. 22. The computer system of 23. The computer system of 24. The computer system of 25. The computer system of 26. A mapping system for mapping business drivers, said mapping system comprising: reviewing a solution set;

identifying a plurality of impact areas; identifying elements of each of the plurality of impact areas; identifying the case specific information for a desired model; and creating the impact area model by business driver. 27. The mapping system of 28. The model engine for building financial models, said model engine comprising; selecting a model interface to interface with data sources;

creating data inputs to receive data from the data sources; create calculation steps for performing calculations using the data from the data sources; testing the model calculations;

creating model inputs; linking a model interface with the model inputs; assign a model type and location; and testing the functionality of the model. 29. The model engine of 30. The model engine of 31. The model engine of 32. A method for creating animations of an image, said method including:

creating an intelligent asset that includes a image to be animated; identifying asset information including standard fields, properties and actions; assigning a location to the asset information; selecting an animation engine; selecting the asset information for use in the engine; and operating the animation engine to show properties and actions of the asset.BACKGROUND OF THE INVENTION

SUMMARY OF THE INVENTION

BRIEF DESCRIPTION OF THE DRAWINGS

DETAILED DESCRIPTION OF THE PREFERRED EMBODIMENTS

Notation and Nomenclature

Decision Information

Milestones